Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

Ameris Bancorp (NASDAQ:ABCB) investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that ABCB isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are several indicators stock traders can use to appraise stocks. A duo of the most underrated indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite money managers can beat the market by a solid amount (see the details here).

Let’s take a look at the fresh hedge fund action encompassing Ameris Bancorp (NASDAQ:ABCB).

How have hedgies been trading Ameris Bancorp (NASDAQ:ABCB)?

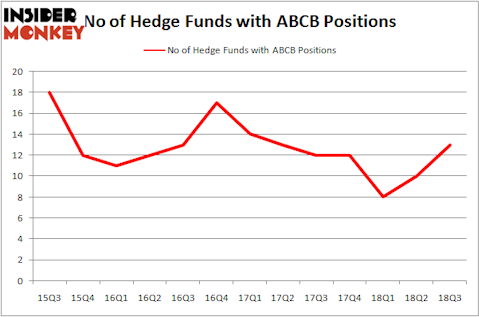

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ABCB over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Ameris Bancorp (NASDAQ:ABCB), which was worth $55.9 million at the end of the third quarter. On the second spot was Polaris Capital Management which amassed $47.9 million worth of shares. Moreover, Mendon Capital Advisors, Marshall Wace LLP, and Castine Capital Management were also bullish on Ameris Bancorp (NASDAQ:ABCB), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names have jumped into Ameris Bancorp (NASDAQ:ABCB) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most valuable position in Ameris Bancorp (NASDAQ:ABCB). Marshall Wace LLP had $16.1 million invested in the company at the end of the quarter. Mark Lee’s Forest Hill Capital also made a $5.9 million investment in the stock during the quarter. The other funds with brand new ABCB positions are Gregg Moskowitz’s Interval Partners, David Costen Haley’s HBK Investments, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s go over hedge fund activity in other stocks similar to Ameris Bancorp (NASDAQ:ABCB). We will take a look at Clear Channel Outdoor Holdings, Inc. (NYSE:CCO), Tenneco Inc (NYSE:TEN), Xencor Inc (NASDAQ:XNCR), and 3D Systems Corporation (NYSE:DDD). This group of stocks’ market valuations resemble ABCB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCO | 13 | 80607 | 1 |

| TEN | 22 | 123481 | -2 |

| XNCR | 15 | 223205 | 0 |

| DDD | 14 | 110314 | 2 |

| Average | 16 | 134402 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $134 million. That figure was $193 million in ABCB’s case. Tenneco Inc (NYSE:TEN) is the most popular stock in this table. On the other hand Clear Channel Outdoor Holdings, Inc. (NYSE:CCO) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Ameris Bancorp (NASDAQ:ABCB) is even less popular than CCO. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.