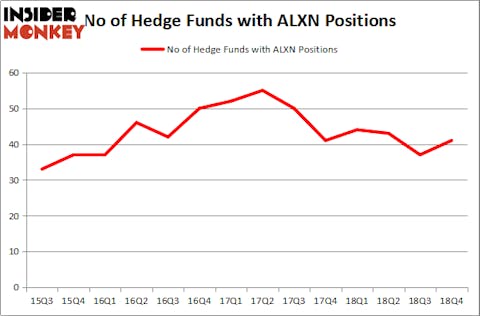

Is Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) an attractive stock to buy now? Money managers are betting on the stock. The number of bullish hedge fund bets increased by 4 recently. Our calculations also showed that ALXN isn’t among the 30 most popular stocks among hedge funds. ALXN was in 41 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 37 hedge funds in our database with ALXN positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the fresh hedge fund action regarding Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN).

How have hedgies been trading Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN)?

At Q4’s end, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the previous quarter. On the other hand, there were a total of 44 hedge funds with a bullish position in ALXN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Baker Bros. Advisors, managed by Julian Baker and Felix Baker, holds the most valuable position in Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). Baker Bros. Advisors has a $833 million position in the stock, comprising 6.8% of its 13F portfolio. Coming in second is David Cohen and Harold Levy of Iridian Asset Management, with a $242.9 million position; 3.3% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions consist of Samuel Isaly’s OrbiMed Advisors, William Leland Edwards’s Palo Alto Investors and D. E. Shaw’s D E Shaw.

As one would reasonably expect, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, initiated the most valuable position in Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). Millennium Management had $64 million invested in the company at the end of the quarter. Arthur B Cohen and Joseph Healey’s Healthcor Management LP also initiated a $60.4 million position during the quarter. The following funds were also among the new ALXN investors: Stephen DuBois’s Camber Capital Management, Ray Dalio’s Bridgewater Associates, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s also examine hedge fund activity in other stocks similar to Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). We will take a look at NXP Semiconductors NV (NASDAQ:NXPI), Tencent Music Entertainment Group (NYSE:TME), McKesson Corporation (NYSE:MCK), and Xilinx, Inc. (NASDAQ:XLNX). All of these stocks’ market caps resemble ALXN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NXPI | 72 | 3502451 | -6 |

| TME | 25 | 317418 | 25 |

| MCK | 44 | 1957258 | 2 |

| XLNX | 48 | 1156752 | 12 |

| Average | 47.25 | 1733470 | 8.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47.25 hedge funds with bullish positions and the average amount invested in these stocks was $1733 million. That figure was $2167 million in ALXN’s case. NXP Semiconductors NV (NASDAQ:NXPI) is the most popular stock in this table. On the other hand Tencent Music Entertainment Group (NYSE:TME) is the least popular one with only 25 bullish hedge fund positions. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is not the least popular stock in this group and hedge fund interest is still below average. However, a new cohort of hedge funds started investing in the stock in Q4 right before the large gains in stock in Q1. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on ALXN as the stock returned 39.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.