Mutual funds and exchange-traded funds (ETF) that focuses on dividend stocks can be good sources of ideas about attractive high-yield or high dividend-growth plays. One such ETF is WisdomTree SmallCap Dividend Fund (DES), which invests exclusively in the small-capitalization segment of the US dividend-paying market. The ETF invests in the small-cap companies that “compose the bottom 25% of the market capitalization of the WisdomTree Dividend Index, after the 300 largest companies have been removed.” Investors pursuing small-cap income investment strategy can benefit from both rapid growth in top- and bottom-lines of the small-cap companies and the high dividend yields for regular income.

WisdomTree SmallCap Dividend Fund, consisting of 615 stocks, has a distribution yield of 3.7% and a low expense ratio of 0.38%. It has returned 15.4% per year over the past three years. We focus our analysis on top five holdings in this small-cap dividend-paying ETF. All featured equities have market capitalizations lower than $2 billion and high dividend yields well exceeding those on the 10-year Treasury bond as well as the S&P 500 and Dow Jones Industrial indices. As the risk-on trade is likely to play out sometime next year when global economies show signs of picking up steam, some of these stocks will represent good investment choices for investors accepting a higher degree of risk for a higher rate of total return.

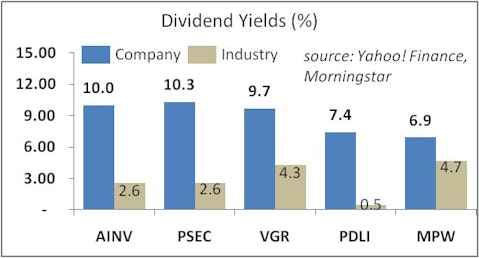

Apollo Investment Corp. (NASDAQ:AINV) is a $1.6-billion business development company and a close-end investment management firm. The company is paying a dividend yield of 10%. The stock is currently operating at a loss, but is expected to return to profitability next year. Based on forward earnings, Apollo Investment’s dividend payout ratio is 93%. As a business development company, Apollo Investment is a pass through entity, which means it distributes at least 90% of its taxable income as dividends. The company’s EPS contracted at an average annual rate of 17% per year over the past five years. Its dividends also shrank at an average annual rate of 15.5% over the same period. Analysts forecast the company’s EPS to grow on average by 5% per year for the next five years. The company is trying to reduce leverage, increase the share of first lien loans, lower percentages of equity and subordinated debt, and increase lending to energy companies. The company’s competitors Prospect Capital Corporation (NASDAQ:PSEC) and Gladstone Capital Corporation (NASDAQ:GLAD) pay dividend yields of 10.3% and 9.5%, respectively. In terms of valuation, the stock has a forward P/E of 9.7x, which is below the ratio of 11.1x for its respective industry but above the ratio of its rival Prospect Capital. The stock has a free cash flow yield of 17%, but its ROE and return on invested capital [ROIC] are currently negative. The stock is down about 2% over the past 12 months. Billionaire Israel Islander (Millennium Management) holds a small stake in the company.

Prospect Capital Corporation (NASDAQ:PSEC) is a $2-billion business development company, one of the largest in the United States. It is a private equity firm providing late venture, middle market, mature and mezzanine finance, buyouts, recapitalizations, growth capital, development, cash flow term loans, and other types of finance. Currently, Prospect Capital is paying a dividend yield of 10.3% on a payout ratio of 73%. Its peer Apollo Investment Corporation is paying a marginally lower yield, while competitor Blackrock Kelso Capital Corp. (NASDAQ:BKCC) is paying a slightly higher yield of 10.5%. Over the past five years, Prospect Capital’s EPS grew at an average annual rate of 9.4%. However, over the same period, dividends shrank at an average annual rate of about 5% per year. Dividends are now paid on a monthly basis. Prospect Capital is expected to grow its EPS at an average annual rate of 5.0% per year for the next five years. Earlier this year, through a public offering of 6.95% senior unsecured notes due 2022 and common stock, the company raised money for investments. In fiscal 2012, Prospect Capital’s earnings jumped 48% over the past year, while the firm earned a 13.6% yield on its investment portfolio. As regards its valuation, the stock is trading on a forward P/E of 8.2x, below its respective industry’s ratio of 11.1x and below the ratio of its competitor BlackRock Kelso Capital at 9.5x. The stock has a ROE of 14.5% and ROIC of 12.6%. It is up 23% over the past year.

Vector Group Ltd (NYSE:VGR) manufactures and sells cigarettes in the United States. The company’s popular brands include Pyramid, Liggett, and Grand Prix. Vector Group’s dividend yields 9.7% on a payout ratio of nearly 7 times its trailing earnings. The company has sustained dividend payouts well in excess of its earnings or free cash flow for years. Vector Group’s peers Altria Group, Inc. (NYSE:MO), Lorillard Inc. (NYSE:LO), and Reynolds American, Inc. (NYSE:RAI) pay dividend yields of 5.3%, 5.3% and 5.6%, respectively. Over the past five years, the company’s EPS and dividends expanded at average rates of 10.7% and 5.0% per year, respectively. Analysts forecast that Vector Group’s EPS will grow at an average annual rate of 11% per year for the next five years. CNBC’s “Mad Money” anchor and former hedge fund manager, Jim Cramer, has recently stated that he “likes Vector’s yield, but his favorite in the group is Philip Morris.” The company is facing risks from an increased regulatory impact. Despite the higher expected EPS in the coming years, this cigarettes maker is facing a declining population of smokers in its U.S. market. Vector Group’s stock has a Retail Opportunity Investments Corp (NASDAQ:ROIC) of 5.4%. In terms of its valuation, the company’s P/E of 64x compares to the industry’s average ratio of 16.5x. The stock is down 2.5% over the past 12 months. Billionaire Jim Simons’ RenTech holds some $68 million in the company’s stock.

PDL BioPharma Inc. (NASDAQ:PDLI) is a $1.1-billion company engaged in intellectual property asset management and royalty-bearing assets investment activities. The company is involved in a patented process to create humanized antibodies so as to create targeted treatments for cancer and immunologic diseases. It earns revenue from licensing its intellectual property to companies such as Genentech (owned by Roche) and Eli Lilly. The company currently pays a dividend yield of 7.4%. Its payout ratio is 47%. Competitors XOMA Corporation (NASDAQ:XOMA), Regeneron Pharmaceuticals Inc (NASDAQ:REGN), and Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) are not paying any dividends. PDL BioPharma saw its EPS shrink at an average annual rate of about 1.0% over the past five years. The company has maintained a quarterly dividend of $0.15 since March 2011. Analysts forecast that the company’s EPS will grow at an average annual rate of 15.5% per year for the next five years. Given the expectation of a robust EPS growth in the future, dividends may increase as well. The risks associated with this company are patent expirations. The company is schedule to cease receiving royalties by first quarter of 2016. PDL BioPharma has a free cash flow yield of 10.6% and ROIC on a five-year average basis of 37.5%. In terms of valuation, PDL BioPharma has a forward P/E of only 4.9x, which compares to the average for the biotech industry of 20.4x. The stock has gained more than 40% over the past 12 months. Jim Simons is also a big fan of this stock.

Medical Properties Trust, Inc. (NYSE:MPW) is a $1.5-billion real estate investment trust that acquires, develops, invests in, and leases healthcare facilities in the United States. In fact, investment in this stock can be viewed as a play on the physical hospital facilities. As a REIT, the company pays out at least 90% of its income to unitholders. This REIT pays a dividend yield of 6.9%. The current dividend coverage ratio is about 91% of funds from operations. The year 2013 coverage targets are projected for about 75% amid a projected continued improvement in performance. The company’s quarterly dividend was reduced in 2008 to the current $0.20 per share. The REIT’s peers HCP, Inc. (NYSE:HCP) and Healthcare Realty Trust Inc (NYSE:HR) pay lower dividend yields of 4.5% and 5.2%, respectively. After a contraction in its EPS over the past five years, Medical Properties Trust is expected to see EPS growth averaging 10.4% per year for the next five years. The company’s Q2 2012 Adjusted Funds from Operations jumped 37.5% from the year-earlier level. The future looks bright given the higher hospital services demand from the aging population of baby boomers. Still, the stock has low ROE and ROIC. In terms of valuation, Medical Properties Trust’s forward P/E of 18.1x is lower than the ratios of 23.5x for HCP, Inc., 47.2x for Health Care REIT, Inc. (NYSE:HCN), and 128.5x for Healthcare Realty Trust Incorporated. The stock has rallied 13% over the past year. Hedge fund manager and value investor Amy Minella (Cardinal Capital) is bullish about Medical Properties Trust.