For every stock, there are always two sides of investment argument. For Herbalife, I am sure readers will be familiar with both bullish and bearish side of the story. So, I won’t rehash them again here. Instead, I will directly address why Ackman’s key argument is flawed.

Distributing rewards > Retail profit does not imply organization is a pyramid scheme

Ackman’s key argument is “if participants make more money from recruiting rewards rather than retail sales, the organization is deemed to be a pyramid scheme”. He devoted the first half of his 334 slide presentation just to prove that Herbalife’s distributors make more money from recruiting rewards rather than retail sales. More recently in Harbors Conference, he said that an organization in which participants makes more money by recruiting other distributors as compared to retail sales is deemed to collapse as eventually the organization would run out of interested distributors.

In this article, I will be showing why this argument is flawed with the help of an example.

Consider an MLM Company which produces and sells product X through its distributors. The average cost of production of X is $15. The company sells this product at $30 to distributors who in turn sell this product at $35 to Retail clients. For simplicity, let us assume 100% of sales are outside the network and there is zero self-consumption among distributors. Also, for this example let’s assume recruiting rewards are limited only to the one level directly hired by the participant. (You may of course assume multiple levels of recruiting or upline rewards, but that would unnecessarily complicate things. Hence, I am avoiding it to keep things simple in this illustration).

Here are the incentives for distributors:

1). $5 profits for retail sales

2). $10 reward for hiring a new distributors

Other important conditions:

1). Zero self-consumption

2). Zero upfront cost for participation

3). At least 1 sale to be classified as distributor

4). No commission on sales made by down line distributors (for simplicity)

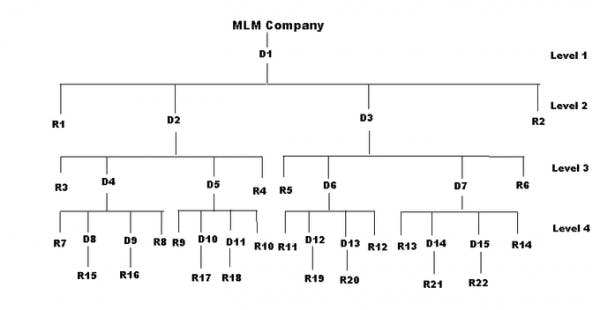

Suppose the MLM organization develops in a symmetric way where each distributor does two retail sales and hires two new distributors, until the final level “n” when the organization runs out of prospective distributors. In final level, since there are no willing new hires for distributors, existing distributors will do just a single retail sale each to qualify as distributor and will not hire anyone. The following diagram illustrates this MLM scheme when there are just four levels of distributors. (Please note that I have to assume organization develops in a symmetrical way to avoid unnecessary complication in developing model. In reality, it may be a different, more complicated structure but the outcome will be the same.)

Let’s see how much do the participants in above scheme earn from retail sales and recruiting rewards if the scheme goes up to four levels.

At Level 1, Distributor D1 earns $20 for hiring D2 and D3 (recruiting reward) and $10 for two retail sales to R1 and R2.

At Level 2, Distributor D2 and D3 earns $20 each as recruiting rewards and $10 each for retails sales.

At Level 3, Distributors D4, D5, D6 and D7 earns $20 each as recruiting rewards and $10 each for retail sales.

At Level 4 or the final level, Distributors D8, D9, D10, D11, D12, D13, D14, D15 earns $5 each for retail sales and nothing for recruiting rewards.

The following table summarizes above outcome

| Recruiting Rewards | Retail Earnings | |

| Level 1 | $20 | $10 |

| Level 2 | $40 | $20 |

| Level 3 | $80 | $40 |

| Level 4 | $0 | $40 |

| Total Recruiting Rewards = $140 | Total Retail Earnings = $110 |

Clearly, Recruiting rewards for this scheme are greater than retail rewards. In the above example, I have gone till four levels only. However, for any number of levels >1, the outcome will always be recruiting rewards greater than retail earnings. Does this makes above MLM company a ponzi or pyramid scheme causing great harm to its participants? The answer is No.

All participants gained in the above scheme. Participant at Level 1, 2 and 3 made $30 each. Participants at Level 4 made $5 each. Although participants at Level 4 didn’t make as much as other levels, they did made money as there was no exorbitant fees to join the MLM.

The MLM company made 22 retail sales of $35 each or $770 in revenues. It gave $250 in recruiting and retail rewards, incurred $330 in product costs and netted $190 in profit before tax.

The MLM Company mentioned above is a 100% legitimate business with genuine customer base. So, clearly Bill Ackman’s argument that if recruiting rewards are greater than retail sales than the MLM company is a pyramid scheme is flawed. This is not a sufficient condition to conclude that an organization is a pyramid scheme. (In fact this is not even a necessary condition for a pyramid organization. I can give examples to show that, leave your contact details/email in comments below in case you are interested).

The issue of internal consumption

One of the assumptions I have taken in the above case is that 100% of sales are outside the network. Will internal consumption change anything?

The issue of internal consumption is an interesting one and there have been a lot of debate going on it. Tupperware Brands Corporation (NYSE:TUP), which is another MLM company, has put a detailed white paper on its website which describes two kind of MLM organizations “Sell and Earn” and “Save and Consume”.

“Sell and Earn”

An organization in which participant’s main aim is to sell the product and earn commissions.

“Save and Consume”

An organization in which participant’s main aim is to obtain discount on the products which they are buying.

“Sell and Earn” is primarily suited for organizations which sells relatively high ticket items with less repeat purchase potential. For eg, Kitchenwares from Tupperware.

“Save and Consume” is usually good for organizations which retail items with low ticket sizes and have a good chance of repeat consumption like nutritional supplements or beauty lotions etc. This makes sense because if I am buying an item which I know I will be repeatedly purchasing, it makes sense for me to join the organization to get a discounted price.

Tupperware’s CEO recently has praised his organization’s “Sell and Earn” model. However one should understand that it has more to do with the type of product they sell: Kitchenwares requiring less repeat purchases. Tupperware has failed miserably when they tried to apply the same model to their beauty product offerings. North American sales of their beauty products have been on a decline for last several years and I believe it has more to do with their “Sell and Earn” model than anything else.

Thus, “Save and Consume” model is not inferior to “Sell and Earn” model. In fact, the type of model a company is using or should use is much more dependent on the type of products they are selling and whether their products require repeat purchases. As long as internal consumption is not just incidental to participation in a scheme, it is as good as external retail sales and it won’t change anything in my example above. In fact FTC’s 2004 advisory clearly states that “the amount of internal consumption in any multi-level compensation business does not determine whether or not the FTC will consider the plan a pyramid scheme.”

Conclusion

To sum up, Bill Ackman’s argument that Herbalife is a pyramid scheme because its distributors make more money from recruiting others rather than retail sales is utterly flawed and misleading. Also, Herbalife’s “Save and Consume” model/ internal consumption cannot be held against it when compared to companies like Tupperware.

Bonus

I am sure you must be wondering if recruiting rewards versus retail profit argument is clearly flawed why is it getting so much attention off late and is even seen in some of the FTC letters. Here’s the answer:

Many organizations charge high joining fees and use a part of the fees from new joiners to pay older ones as recruitment reward. The rest goes to the promoters of organizations as profit. These structures where recruitment rewards and organization profits are not having retail basis are clear examples of pyramid schemes. The key here is high joining fee which makes a sizable amount of organization/ older distributor’s profit share. If the contribution of joining fees to organizations total profit is not material, it is unlikely that the organization will turn out to be a pyramid scheme and attract FTC action.

The article Why Bill Ackman’s Key Argument Is Flawed originally appeared on Fool.com and is written by Shweta Dubey.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.