Insider Monkey believes in mimicking hedge funds’ long positions, because research-based evidence consistently prove that the smart money returns positive gains from long sides of its portfolios. The sterling returns of hedge funds are often eclipsed by hedged positions and high fees. Our data for hedge funds’ third-quarter returns backs this up, as the funds in our database with at least five long positions in billion-dollar companies on June 30, had an average return of 8.3% in the third quarter. Meanwhile, the Barclay Hedge Fund Index has hedge funds’ actual returns for the third-quarter at less than 4%, though it should be noted that the Barclay’s Index tracks the performance of thousands of funds, while we focus solely on the cream of the hedge fund crop. Thus, in this article we’ll take a look at four long positions held by Night Owl Capital Management, including Alphabet Inc (NASDAQ:GOOG), Starbucks Corporation (NASDAQ:SBUX), Sensata Technologies Holding N.V. (NYSE:ST) and Tyler Technologies, Inc. (NYSE:TYL).

Night Owl Capital Management is a Connecticut-based hedge fund founded in 1993 by John Kim. Night Owl’s equity portfolio disclosed an equity portfolio worth nearly $170 million as of the end of September, up from $140.13 million at the end of June. The fund returned 12.03% from 16 of its long positions in companies worth over $1.0 billion.

crystal51/Shutterstock.com

During the third quarter, as the stock gained 12.3%, Night Owl trimmed its stake in Alphabet Inc (NASDAQ:GOOG) by 1% to 19,244 class C shares worth $14.96 million. At the end of June, a total of 126 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from the previous quarter. The largest stake in Alphabet Inc (NASDAQ:GOOG) was held by Eagle Capital Management, which reported holding $1.28 billion worth of stock as of the end of June. It was followed by Southeastern Asset Management with a $669.8 million position. Other investors bullish on the company included Egerton Capital Limited, Lone Pine Capital, and Viking Global.

Follow Alphabet Inc. (NASDAQ:GOOG)

Follow Alphabet Inc. (NASDAQ:GOOG)

Receive real-time insider trading and news alerts

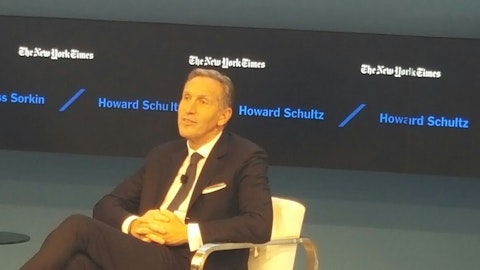

In Starbucks Corporation (NASDAQ:SBUX), Night Owl held 150,717 shares worth $8.16 million at the end of September, down by 1% over the quarter. Between July and September, the stock lost 4.9%. During the second quarter, the number of funds from our database long Starbucks Corporation inched up by 2% to 53. Among these funds, Melvin Capital Management held the most valuable stake in Starbucks Corporation (NASDAQ:SBUX), which was worth $142.8 million at the end of the second quarter. On the second spot was Columbus Circle Investors which amassed $135 million worth of shares. Moreover, Adage Capital Management, Citadel Investment Group, and Melvin Capital Management were also bullish on Starbucks Corporation (NASDAQ:SBUX).

Follow Starbucks Corp (NASDAQ:SBUX)

Follow Starbucks Corp (NASDAQ:SBUX)

Receive real-time insider trading and news alerts