Known as the “eBay Inc (NASDAQ:EBAY) of Latin America,” online auction site Mercadolibre Inc (NASDAQ:MELI) is often hailed as one of the great emerging market stocks – and for good reason. The company enjoys a majority e-commerce market share in nearly every developed country in Latin America – a fertile ground for online retail thanks to rising Internet penetration, increased credit card usage, and a growing middle class. So what makes MercadoLibre tick? Will the company continue to grow, or will concerns about declining GDP and rising inflation hurt the company’s growth prospects?

The Foolish Fundamentals

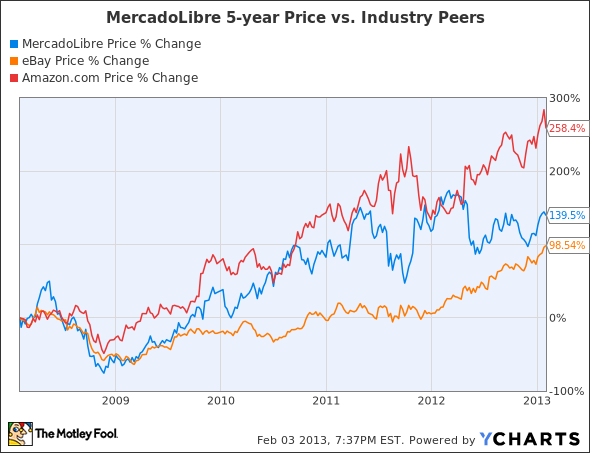

MercadoLibre caught my eye during a recent search for momentum growth stocks. I wanted to find stocks that had demonstrated strong past performance through high ROI and ROE, as well as powerful momentum based on high expectations, using higher than average P/E ratios.

Here are the minimum criteria I initially set.

1). Market Cap: 1 Billion

2). P/E Ratio: 40

3). Gross Margin: 25%

4). 5-year Revenue Growth Rate: 25%

5). 5-year EPS Growth Rate: 25%

6). 5-year Return on Equity: 25%

7). 5-year Return on Investment: 25%

Only three stocks in the entire U.S. market fit all seven criteria: Lululemon Athletica inc. (NASDAQ:LULU), Mercadolibre Inc (NASDAQ:MELI) and SolarWinds Inc (NYSE:SWI). MercadoLibre interested me the most, as it would complement my previous article regarding Amazon.com, Inc. (NASDAQ:AMZN)’s growth initiatives in Brazil. So how does MercadoLibre stack up in those seven categories?

Market Cap | P/E (ttm) | Operating Margin % (ttm) | 5 yr. Revenue Growth | 5 yr. EPS Growth | 5 yr. Return on Equity: | 5 yr. Return on Investment |

$3.86B | 41.78 | 33.54% | 265.4% | 670.4% | 39.28 | 37.02 |

Source: Yahoo Finance (data as of 2/3/2013)

That impressive top and bottom line growth shows that Latin America e-commerce is a force to be reckoned with.

The Latin eBay

MercadoLibre (“free market”) is eBay’s Latin American partner, and is currently the region’s number one e-commerce site. It has a sprawling presence across 13 Latin American countries. Its website operates in the same way as eBay – buyers bid on desired items within a limited amount of time to win auctions. MercadoLibre also offers a “fixed price” system – used by 80% of sellers – similar to eBay’s “Buy it Now” option.

Buyers then use MercadoPago (which is similar to eBay’s PayPal system), credit cards or money orders to pay. Based on eBay’s incredible success with PayPal, MercadoPago could evolve into a challenger to Visa Inc (NYSE:V) or Mastercard Inc (NYSE:MA), as the market for mobile cashless payments increases.

MercadoLibre became a regional monopoly in 2005, after acquiring primary rival DeRemate’s operations in Brazil, Colombia, Ecuador, Mexico, Peru, Puerto Rico and Venezuela. This move consolidated MercadoLibre’s rule in Latin America, and it has been unchallenged since.

Micro Factors

Due to the international, cross-border nature of its e-commerce business, conflicts have risen when regulated products, such as pharmaceuticals, were shipped by MercadoLibre merchants to other countries without appropriate permits.