Intuitive Surgical, Inc. (NASDAQ:ISRG) is one of the great growth stocks of this new millenium, rising over 4,700% in the past ten years. Although its days of such monstrous returns are over, the Sunnyvale, California-based medical equipment maker is still poised for incredible growth in the next decade. In this article, let’s analyze what makes this manufacturer of futuristic surgical machinery tick.

From the Starship Enterprise’s sickbay into your doctor’s O.R….

Intuitive Surgical’s claim to fame is a single machine – the da Vinci Surgical System, a cutting edge system which translates a surgeon’s natural hand movements into micro-movements of tiny instruments planted inside the patient through small incisions. The system’s technology can even offer 3D and HD microscopic views of the patient, allowing MIS (minimally invasive surgery) to be performed on a smaller scale than ever before. Sales of the da Vinci Surgical System and its accessories comprised approximately 84% of the company’s 2012 revenue, with the remainder generated by service fees.

Foolishly Fantastic Growth

For its fourth quarter, Intuitive Surgical posted earnings of $4.25 per share, easily topping analyst estimates by 21 cents. Its revenue of $609.3 million also topped estimates of $584.4 million. The company has a solid history of beating forecasts by a wide margin.

ISRG Revenue TTM data by YCharts

Over the past five years, Intuitive Surgical has grown revenue 222.9% and diluted earnings 280.5%. The company has kept its top and bottom line growth in sync, a difficult task for many high growth companies. For fiscal 2012, Intuitive Surgical grew its revenue 24% – a double-digit standard that analysts expect to continue into the next two years.

To put Intuitive Surgical’s rapid growth into perspective, the company generated $373 million in 2006. In 2014, it is expected to generate approximately $2.95 billion. Meanwhile, GAAP-adjusted earnings have increased nearly eight-fold from less than $2 per share to nearly $15.04 last year.

Those GAAP-adjusted earnings exclude a tax benefit during the year, which added 94 cents per share. The company is expected to earn $17.65 per share this year, and $20.59 in 2014.

Intuitive Surgical has also kept growing its cash reserves and margins, and has a pristine balance sheet with no debt. In the fourth quarter, the company grew its cash and investments by $200 million to finish the year with a $750 million gain. That gives the company a total cash pile of $1.32 billion, which could be allocated to future R&D investments, stock buyback plans or dividends. Intuitive Surgical already has an active stock buyback plan, where the company repurchased $53 million in shares during the fourth quarter.

Fundamental Valuations

Over the past three years, gross margins have consistently come in over 70%, operating margins have exceeded 35%, while profit margins stayed above 20%. These strong margins have contributed to a steadily rising cash hoard.

ISRG Operating Margin TTM data by YCharts

While Intuitive Surgical occupies a niche market with no direct competitors, let’s see how it measures up to comparable market peers, such as MAKO Surgical Corp. (NASDAQ:MAKO), which creates robotic prosthetics, and standard medical equipment maker Boston Scientific Corporation (NYSE:BSX).

| Forward P/E | 5-year PEG | Price to Sales (ttm) | Debt-to-Equity | Return on Equity (ttm) | Profit Margin | |

| MAKO Surgical | Not profitable | -0.59 | 4.68 | No Debt | -33.07% | -30.75% |

| Boston Scientific | 15.81 | 2.33 | 1.43 | 61.95 | -44.65% | -56.12% |

| Intuitive Surgical | 27.75 | 1.81 | 10.53 | No debt | 21.09% | 30.14% |

| Advantage | Boston Scientific | Intuitive Surgical | Boston Scientific | MAKO/ Intuitive Surgical | Intuitive Surgical | Intuitive Surgical |

Source:Yahoo Finance

From this comparison, we can conclude that although Boston Scientific is the most undervalued stock, but Intuitive Surgical has the most stable returns and margins, as well as the strongest potential for future growth.

Aiming for a Soft Landing

As with most growth stocks, Intuitive Surgical’s P/E and P/S ratios appear overheated, but its clean balance sheet and strong top and bottom line growth justify its higher valuation.

It’s important to remember that every growth stock must go through a transition where its P/E declines to a more sustainable level. Of course, some stocks such as Amazon.com, Inc. (NASDAQ:AMZN) grow so fast that their P/E ratios stay at extremely high levels; other companies such as Google Inc (NASDAQ:GOOG) reconcile their stock price to actual earnings so they can stably grow.

However, one fact remains constant – a decline in P/E ratio usually precedes a loss in momentum. That’s how growth stocks eventually become value stocks.

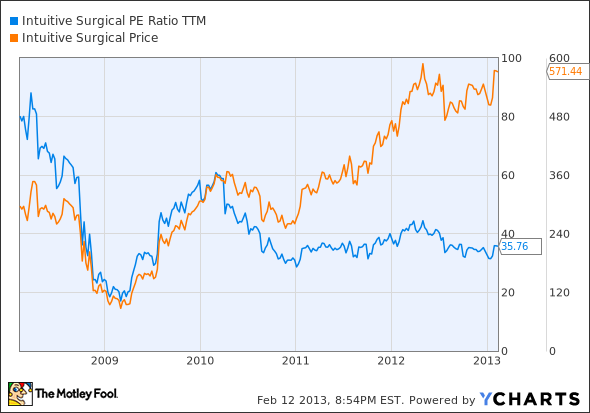

ISRG PE Ratio TTM data by YCharts

From this comparison of its P/E ratio and price change over the past five years, we can see that Intuitive Surgical’s P/E ratio stabilized in the beginning of 2011, but its price has steadily increased – which shows that the market is constantly fairly valuing the stock, despite its premium price compared to its industry peers.

The Foolish Bottom Line

Intuitive Surgical occupies an enviable position in the medical equipment market – it only makes one main product, but it has been so widely accepted and its brand so widely known that it is expanding unopposed into hospitals nationwide. The company’s incredible top and bottom line growth, coupled with strong margins, rising cash reserves and zero debt, all make Intuitive Surgical an ideal long-term investment in a technology that may become a hospital standard in the next decade.

The article Intuitive Investors Should Invest in Intuitive Surgical originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.