Are Apple Inc. (NASDAQ:AAPL), CONSOL Energy Inc. (NYSE:CNX), Michael Kors Holdings Ltd (NYSE:KORS), and Yahoo! Inc. (NASDAQ:YHOO) stocks that you should be bullish on? One investor that clearly thinks so is David Einhorn of Greenlight Capital, which amassed large positions in these companies, among others. Since following some of the most skilled stock-pickers can be a good strategy to outperform the market, let’s take a closer look at these four companies and assess both Greenlight Capital’s investments in them and the general smart money sentiment towards them.

Before we get to that, we should mention that Greenlight is one of the best-performing hedge funds, which returned 7.8% in the first nine months of 2016 and 3.4% (net of fees and expenses) in the third quarter. According to our calculations, Greenlight’s 39 long positions in companies worth at least $1.0 billion posted a weighted average return of 11.39% during the July-September period. Heading into the last quarter, Greenlight held an equity portfolio worth $5.45 billion, which was diversified across various sectors, with consumer discretionary, technology, and industrial stocks amassing the largest shares.

Apple Inc. (NASDAQ:AAPL) represented Greenlight Capital’s largest holding at the end of June, as the fund reported a $655.31 million position containing 6.85 million shares (down by 16% over the quarter). The investment paid off big time in the following three months, as shares of Apple advanced by 18.9%. Overall, there were 116 funds tracked by Insider Monkey that held long positions in the company at the end of June, down by 24% over the quarter. More specifically, Berkshire Hathaway was the largest chareholder of Apple Inc. (NASDAQ:AAPL), with a stake worth $1.46 billion reported as of the end of June. Trailing Berkshire Hathaway was Fisher Asset Management, which amassed a stake valued at $1.10 billion. Adage Capital Management, Greenlight Capital, and Soroban Capital Partners also held valuable positions in the company.

Follow Apple Inc. (NASDAQ:AAPL)

Follow Apple Inc. (NASDAQ:AAPL)

Receive real-time insider trading and news alerts

Another profitable investment of Greenlight Capital was CONSOL Energy Inc. (NYSE:CNX), in which the fund trimmed its stake by 25% to 22.0 million shares worth $353.98 million during the second quarter. During the third quarter, shares of CONSOL Energy advanced by 19.3%. A total of 34 funds from our database were bullish on this company at the end of June, with Southeastern Asset Management holding the most valuable stake in CONSOL Energy Inc. (NYSE:CNX), which was worth $797.1 million. Moreover, East Side Capital (RR Partners), Blue Ridge Capital, and Arrowstreet Capital were also bullish on CONSOL Energy Inc. (NYSE:CNX).

Follow Cnx Resources Corp (NYSE:CNX)

Follow Cnx Resources Corp (NYSE:CNX)

Receive real-time insider trading and news alerts

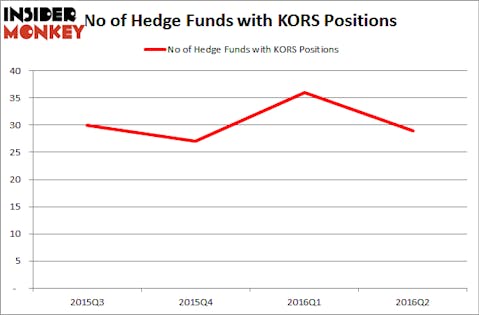

Michael Kors Holdings Ltd (NYSE:KORS)‘s stock inched down by 5.4% during the third quarter, while Greenlight Capital had entered the quarter with a $239.24 million stake containing 4.84 million shares. Even though Greenlight cut its stake in the company by 28% between April and June, it still was the largest shareholder among the 29 funds from our database that held shares of Michael Kors Holdings Ltd (NYSE:KORS). Greenlight was trailed by AQR Capital Management with a $130.7 million position. Other investors bullish on the company included Point72 Asset Management, Scopus Asset Management, and Renaissance Technologies.

Follow Capri Holdings Ltd (NYSE:CPRI)

Follow Capri Holdings Ltd (NYSE:CPRI)

Receive real-time insider trading and news alerts

Last but not least, in Yahoo! Inc. (NASDAQ:YHOO), Greenlight owned 4.41 million shares valued at $165.57 million at the end of June. In the following quarter, the fund saw the stock appreciate by 14.7%. Between June and September, the number of funds from our database long Yahoo! Inc. (NASDAQ:YHOO) declined by 16% sequentially to 81. Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors amassed the biggest position, which was worth $697.6 million and it was followed by Owl Creek Asset Management, led by Jeffrey Altman, holding a $569.2 million position. Remaining hedge funds and institutional investors that hold long positions contain Jeffrey Smith’s Starboard Value LP, David Cohen and Harold Levy’s Iridian Asset Management and Sander Gerber’s Hudson Bay Capital Management.

Follow Altaba Inc. (NASDAQ:AABA)

Follow Altaba Inc. (NASDAQ:AABA)

Receive real-time insider trading and news alerts

Disclosure: none