The Mergent’s Dividend Achievers 50 Index, a subset of the U.S. Broad Dividend Achievers Index, focuses on 50 highest yielding stocks that have a history of increasing dividends for at least ten years. To be included in the index, the index constituents also need to have a daily trading volume of at least $500,000. It should be noted that, in some cases, high yields of certain index constituents reflect higher risks associated with the nature of the company’s business operations.

Investors in pursuit of quality dividend stocks that have a proven history of raising dividends and a consistent earnings power can identify among The Mergent’s Dividend Achievers 50 Index constituents several high-yielding energy sector plays. Here, we focus on five high-yielding master limited partnerships (MLPs), including Enterprise Products Partners L.P. (NYSE:EPD), Plains All American Pipeline L.P. (NYSE:PAA), Magellan Midstream Partners L.P. (NYSE:MMP), and TC Pipelines, LP (NYSE:TCP), and a high-quality dividend stock, Murphy Oil Corporation (NYSE:MUR).

Enterprise Products Partners L.P.

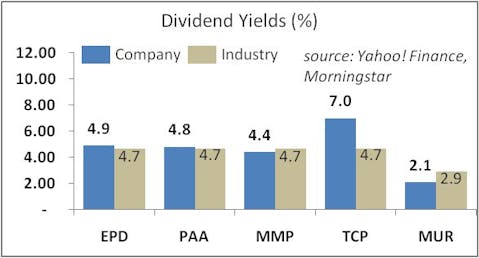

This MLP is a midstream energy services company that processes and transports natural gas, refined products, and natural gas liquids (NGLs). It pays a distribution yield of 4.9% and its distribution coverage ratio is 1.36x. This MLP has raised distributions five times over the past 12 months, resulting in a cumulative increase of 6%. This is consistent with its five-year dividend growth rate averaging about 6% per year. Enterprise Products Partners L.P.’s peers Plains All American Pipeline L.P. (PAA) and Magellan Midstream Partners L.P. (MMP) have lower distribution yields of 4.8% and 4.4%. EPD derives a large share of its operating income from fee-based long-term contracts, which secures cash flows for distributions. EPD has the capacity to expand operations so as to generate strong cash flow growth and thus to boost future distributions. The stock has a ROE of 20.4% and a ROIC of 9.4%. The company’s forward P/E of 21.5x compares with 18.5x for Plains All American Pipeline and 21.6x for Magellan Midstream Partners. The MLP is up 21.4% over the past 12 months. Fund manager John Osterweis (Osterweis Capital Management) holds more than $70 million in the stock.

Plains All American Pipeline L.P.

This midstream MLP engages in the transportation, storage, and marketing of crude oil, refined products, and natural gas liquids in the United States and Canada. The MLP pays a distribution yield of 4.8% on a distribution coverage ratio of 1.65x. Competitor Enterprise Products Partners pays a higher distribution yield, while peer Magellan Midstream Partners pays a slightly lower distribution yield. Plains All American Pipeline raised its distribution five times over the past 12 months, with a cumulative increase of 9.1%. The company’s stock split 2:1 in October. Over the past five years, Plains All American Pipeline’s dividends grew at an average rate of 5.3% per year. The company benefits from highly predictable incomes generated from long-term contracts. It has a major exposure to the lucrative oil market, with pipeline assets located in the high-growth production zones, such as the Bakken, the Permian Basin, and the Eagle Ford. The company has a large number of new projects in the pipeline, expected to start production and cash flow generation over the next several years. The stock has a ROE of 19% and a Retail Opportunity Investments Corp (NASDAQ:ROIC) of 9.8%. In terms of valuation, it is priced on a forward P/E below those of its main competitors. The stock has gained 41.6% over the past 12 months. Among fund managers, billionaire Jim Simons owns the largest stake in the stock worth some $30 million.

Magellan Midstream Partners L.P.

Magellan Midstream Partners is a midstream energy company engaged in the transportation, storage, and distribution of petroleum products in the United States. The MLP pays a distribution yield of 4.4% on a distribution coverage ratio of 1.37x. The MLP raised its distributions five times over the past 12 months, with a cumulative increase of 21.25%. Magellan Midstream Partners’ stock also split 2:1 in October. The MLP’s five-year dividend growth averaged about 6.7% per year. Competitors such as All Plains American Pipeline and Enterprise Products Partners pay higher distribution yields. Magellan Midstream Partners announced plans to boost cash distributions by 18% this year, double the previously expected rate. For 2013, the partnership plans to increase distributions by another 10%. The company has a stable cash flow generation model. Moreover, it has entered into a number of partnerships and alliances to boost its operations. In July, Magellan Midstream Partners and Occidental Petroleum Corporation (NYSE:OXY) announced plans to establish a joint venture to build a 400-mile long oil transport pipeline. The stock has a ROE of 30.4% and a ROIC of 12.3%. As regards its valuation, the stock has a forward P/E almost on par with its competitor Enterprise Products Partners. The stock is up 36.2% over the past year. Fund manager John Osterweis is also bullish about this MLP.

TC PipeLines L.P.

This MLP is engaged in the transportation of natural gas to market hubs and consuming markets in the United States and central Canada. TC PipeLines pays a distribution yield of 7.0% with a distribution coverage ratio of 1.21x. This MLP raised its distributions at an average annual rate of 3.8% over the past five years. In the last 12 months, the MLP has raised distributions only marginally. Still, its distributions are mostly safe while the yield is especially appealing. The MLP pays a distribution yield much higher than that of the previous three partnerships. Its competitors TransCanada Corporation (NYSE:TRP) and Enbridge Inc (NYSE:ENB) pay dividend yields of 4.0% and 2.9%, respectively. TC PipeLines has a stable business model, but there are some concerns about its natural gas fundamentals and possible cost overruns on expansion projects, according to Zacks Investments. The MLP has a ROE of 11.6% and a ROIC of 7.6%. In terms of valuation, it has a forward P/E of 17.1x, below the pipelines industry’s ratio of 19.0x and those for Enterprise Products Partners and Plains All American Pipeline. The stock is down 3.2% over the past 12 months. Jim Simons and Cliff Asness have minor holdings of this MLP.

Murphy Oil Corporation

This is an $11.6-billion oil and natural gas company that produces, refines, and markets petroleum products. The company pays a dividend yield of 2.1% on a payout ratio of 28%. Its peers BP plc (NYSE:BP) and Exxon Mobil Corporation (NYSE:XOM) pay dividend yields of 4.6% and 2.5%, respectively. Over the past five years, Murphy Oil Corporation saw its EPS and dividends grow at average annual rates of 2.3% and 12.3%, respectively. Analysts forecast that the company’s EPS will grow at an accelerated average annual rate of 10.6%. The company recently announced a plan to spin-off its U.S. downstream subsidiary, Murphy Oil USA, Inc. (Murphy USA), into an independent and separately traded company. The company also authorized “a special dividend of $2.50 per share for a total dividend of approximately $500 million and a share buyback program of up to $1 billion of the company’s shares of common stock.” The spin-off will be finalized in 2013 and the special dividend will be payable on December 3, 2012 to shareholders of record as of November 16, 2012. Murphy Oil Corporation has a ROE of 9.4% and a ROIC of 8.7%. In terms of valuation, the stock is trading on a forward P/E of 11x, above the integrated oil and gas industry’s ratio of 9.3x. For the reference, Exxon Mobil Corporation has a forward P/E of 11.2x. The stock has rallied 8.2% over the past 12 months. The stock is popular with billionaire Steven Cohen, who owns $243 million in this stock.