Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about XPeng Inc. (NYSE:XPEV) in this article.

Hedge fund interest in XPeng Inc. (NYSE:XPEV) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that XPEV isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cummins Inc. (NYSE:CMI), Xilinx, Inc. (NASDAQ:XLNX), and TransDigm Group Incorporated (NYSE:TDG) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

With all of this in mind we’re going to view the key hedge fund action regarding XPeng Inc. (NYSE:XPEV).

Do Hedge Funds Think XPEV Is A Good Stock To Buy Now?

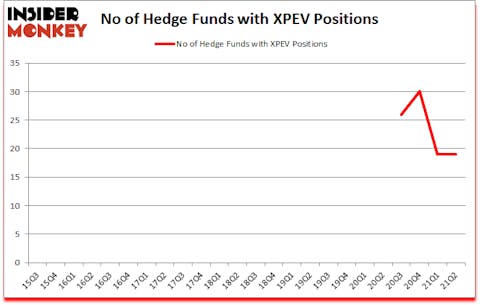

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in XPEV a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, 0 held the most valuable stake in XPeng Inc. (NYSE:XPEV), which was worth $461.1 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $81.8 million worth of shares. Light Street Capital, Marshall Wace LLP, and Hillhouse Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Light Street Capital allocated the biggest weight to XPeng Inc. (NYSE:XPEV), around 2.64% of its 13F portfolio. Coatue Management is also relatively very bullish on the stock, setting aside 1.81 percent of its 13F equity portfolio to XPEV.

Due to the fact that XPeng Inc. (NYSE:XPEV) has experienced falling interest from the entirety of the hedge funds we track, we can see that there were a few money managers that slashed their full holdings by the end of the second quarter. At the top of the heap, Andreas Halvorsen’s Viking Global said goodbye to the biggest investment of all the hedgies monitored by Insider Monkey, comprising an estimated $152.1 million in stock. Simon Sadler’s fund, Segantii Capital, also dumped its stock, about $62.4 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as XPeng Inc. (NYSE:XPEV) but similarly valued. These stocks are Cummins Inc. (NYSE:CMI), Xilinx, Inc. (NASDAQ:XLNX), TransDigm Group Incorporated (NYSE:TDG), Xcel Energy Inc (NASDAQ:XEL), Brown-Forman Corporation (NYSE:BF), Alcon Inc. (NYSE:ALC), and Republic Services, Inc. (NYSE:RSG). This group of stocks’ market valuations are closest to XPEV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMI | 45 | 1102223 | 8 |

| XLNX | 59 | 4162249 | 2 |

| TDG | 57 | 7351832 | -5 |

| XEL | 22 | 235410 | 4 |

| BF | 31 | 1667783 | -4 |

| ALC | 22 | 727825 | -1 |

| RSG | 34 | 1289299 | -2 |

| Average | 38.6 | 2362374 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.6 hedge funds with bullish positions and the average amount invested in these stocks was $2362 million. That figure was $785 million in XPEV’s case. Xilinx, Inc. (NASDAQ:XLNX) is the most popular stock in this table. On the other hand Xcel Energy Inc (NASDAQ:XEL) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks XPeng Inc. (NYSE:XPEV) is even less popular than XEL. Our overall hedge fund sentiment score for XPEV is 24. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds dodged a bullet by taking a bearish stance towards XPEV. Our calculations showed that the top 5 most popular hedge fund stocks returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd but managed to beat the market again by 1.6 percentage points. Unfortunately XPEV wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was very bearish); XPEV investors were disappointed as the stock returned -2.9% since the end of the second quarter (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Xpeng Inc. (NYSE:XPEV)

Follow Xpeng Inc. (NYSE:XPEV)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Best Marijuana Stocks to Invest In

- 10 Biggest Hedge Fund Failures

- 10 Best Gold Stocks to Buy in 2021

Disclosure: None. This article was originally published at Insider Monkey.