Although many voters have traditionally seen the Republican Party as “pro-business” and the Democratic party as “pro-consumer,” the reality on the ground isn’t quite so clear. Democrats in Washington are courted by the same business lobbyists as their GOP counterparts. And Republicans, for their part, are well aware of the fact that any policies deemed too harsh on citizens (and too favorable to corporations) might get them booted out of office at the next election.

But if you ask many people, they’ll tell you Republicans are the best stewards of the economy. And they say investment portfolios are likely to fare better when the Grand Old Party is in the White House.

Yet the facts tell a different story.

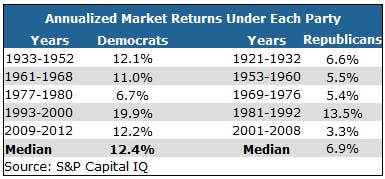

In an unusual twist to conventional wisdom, stocks have actually fared better under Democratic Presidential administrations. That’s the conclusion drawn by analysts at S&P Capital IQ, who analyzed annual market returns during the past nine decades.

Frankly, the margin of victory isn’t even close. Even if you toss out the top period for Democrats (under former President Bill Clinton) and the worst period under Republicans (under former President George W. Bush), Democrats would still come out ahead.

Does that mean stocks are likely to keep performing well, if President Barack Obama is re-elected? Or does it mean stocks won’t post sharp gains if the GOP retakes the White House? To answer this question, we have to go back and look at why the market has done better in some periods than others.

This analysis starts with perceptions about Democrats. Voters have tended to elect a president from this party when the economy is troubled: Franklin D. Roosevelt inherited a lousy economy (and a very weak stock market) from Herbert Hoover. The economy slipped intorecession during Dwight D. Eisenhower’s last year in office in 1960, giving John F. Kennedy a nudge. Jimmy Carter won election during a period of high inflation and rising unemployment. Clinton capitalized on the weak economy overseen by George H.W. Bush, and Obama took office on the heels of a fresh economic crisis.

The common thread here is that Democrats have tended to benefit from a weak economy and low expectations.

Still, you can’t look at market returns in a vacuum. Stocks may have risen 6.7% annually under Jimmy, but they actually lost ground when high inflation is taken into account. Simply put, inflation and interest rates have a much greater effect on stock returns than many realize.

Indeed you can credit a steady drop in inflation and interest rates that began in 1982 for the powerfulbull market that started under Ronald Reagan, continued under George H.W. Bush and then went on for another eight years under Clinton. The fact that the stock market rose more than 15% annually, on average, in that 20-year period, is something we may never witness again.

The end of an era

This all helps explain why your expectations for stock market returns in the years ahead should be much more muted. With inflation and interest rates at post-war lows, they have nowhere to go but up. Indeed you can attribute some of the 15% gain for the S&P 500 during the past year to the fact that few other solid investment choices exist. Bonds and certificates of deposit (CDs) are offering such skimpy yields that investors have concluded they may as well cast their lot with stocks.

But what happens when rates finally rise, and bonds and CDs start to offer more robust payouts? Some of that money will have to come out of stocks.

Action to Take –> Economists suggest investors should expect annualized stock market gains in the 5% to 8% range. Some of these gains will be eaten away by inflation, but your portfolio should still be able to rise in value at a decent clip over the long haul. Yet it’s unwise to expect stellar stock returns, expect after strong market pullbacks, as we saw in the late 1970s or more recently in late 2008 and early 2009.

This article was originally written by David Sterman, and posted on StreetAuthority.