Barclays introduced a new exchange traded note (“ETN”) on October 11 under the ETN+ brand instead of the more familiar iPath brand. The Barclays ETN Schiller CAPE (NYSEARCA:CAPE) will track the Shiller Barclays CAPE US Core Sector Index minus the 0.45% annual fee. The Cyclically Adjusted Price Earnings Ratio, or CAPE Ratio, was originally defined by Robert Shiller and John Y. Campbell in 1988.

The underlying index provides long exposure to the top four US equity sectors that are relatively undervalued (as defined by a modified version of the classic CAPE Ratio) and possess relatively stronger price momentum over the prior twelve months. The index uses the nine S&P Select Sector Indexes as its constituents. Therefore, the Technology and Telecommunications sectors are combined.

The index composition is determined monthly by first assessing the valuation of the nine sectors based on their historical CAPE Ratio. The methodology then selects the top four undervalued sectors possessing relatively stronger price momentum over the prior twelve months. Allocations are equally weighted among the four chosen sectors.

Information on the current index holdings for October could not be located. The index is brand new, having been launched a week earlier on October 5.

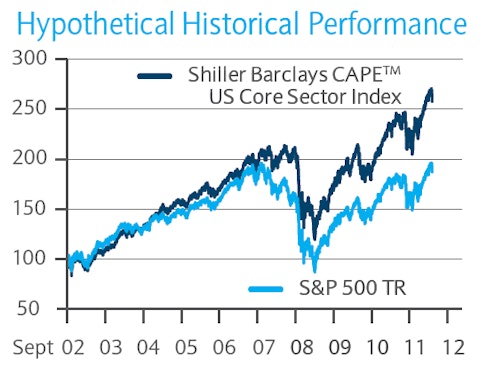

Results from the 10-year hypothetical historical backtest are shown in this graphic from the fact sheet (pdf). The test produced an annualized return of +10.8% (adjusting for investor fees) with 19.6% standard deviation. For the same period, the S&P 500 Total Return Index gained +7.2% with a 21.2% standard deviation.

Additional information can be found on the summary page and in the prospectus (pdf).

Analysis/Opinion: Investors should not be concerned about a repeat of the implementation disaster associated with the last products based on a Shiller index. The Case-Shiller Major Metro Housing ETNs (UMM & DMM) from MacroShares were fundamentally flawed products without the ability to track any index.

As for the product and indexing methodology of CAPE, the 15-page Product Overview (pdf) provides ample information and background. If this sector rotation methodology proves to be viable going forward, the ETN wrapper could provide more tax-efficiency than traditional implementations. It is interesting to note that during an 8-year portion of the backtest, the Materials, Utilities, and Technology sectors handily outperformed the S&P 500, yet were seldom selected for the index.

Barclays continues to confuse investors with its multiple brands and lack of clarity regarding those brands. Barclays’ “iPath” brand is very familiar to most ETF/ETN investors, but CAPE is part of the BARX website and carries the “ETN+” brand. To add to the confusion, some Barclays notes originally launched as ETN+ products were subsequently moved to the iPath brand. Additionally, ads touting “transparent and efficient products” on the BARX website seem to miss the mark, as the index holdings could not be found.

This article was originally written by Ron Rowland, and posted on InvestWithAnEdge.