Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Colony Bankcorp Inc (NASDAQ:CBAN)? The smart money sentiment can provide an answer to this question.

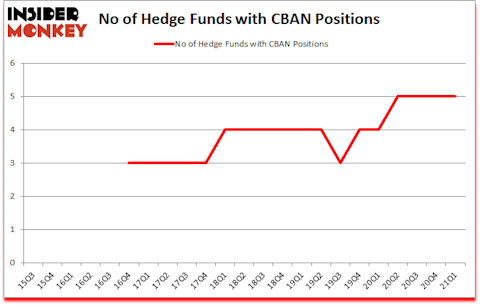

Hedge fund interest in Colony Bankcorp Inc (NASDAQ:CBAN) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that CBAN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). At the end of this article we will also compare CBAN to other stocks including IMARA Inc. (NASDAQ:IMRA), Bogota Financial Corp. (NASDAQ:BSBK), and Anixa Biosciences, Inc. (NASDAQ:ANIX) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, an activist hedge fund owns nearly 40% of this $23 biotech stock and is trying to buy the rest for around $50. So, we recommended a long position to our monthly premium newsletter subscribers. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s analyze the new hedge fund action regarding Colony Bankcorp Inc (NASDAQ:CBAN).

Do Hedge Funds Think CBAN Is A Good Stock To Buy Now?

At first quarter’s end, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2020. By comparison, 4 hedge funds held shares or bullish call options in CBAN a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Polaris Capital Management held the most valuable stake in Colony Bankcorp Inc (NASDAQ:CBAN), which was worth $6.4 million at the end of the fourth quarter. On the second spot was Fourthstone LLC which amassed $6.3 million worth of shares. Renaissance Technologies, Tontine Asset Management, and GAMCO Investors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Fourthstone LLC allocated the biggest weight to Colony Bankcorp Inc (NASDAQ:CBAN), around 3.13% of its 13F portfolio. Polaris Capital Management is also relatively very bullish on the stock, earmarking 0.21 percent of its 13F equity portfolio to CBAN.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now review hedge fund activity in other stocks similar to Colony Bankcorp Inc (NASDAQ:CBAN). These stocks are IMARA Inc. (NASDAQ:IMRA), Bogota Financial Corp. (NASDAQ:BSBK), Anixa Biosciences, Inc. (NASDAQ:ANIX), County Bancorp, Inc. (NASDAQ:ICBK), Vericity, Inc. (NASDAQ:VERY), Charah Solutions, Inc. (NYSE:CHRA), and Mediwound Ltd (NASDAQ:MDWD). This group of stocks’ market valuations match CBAN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IMRA | 5 | 26014 | 0 |

| BSBK | 1 | 188 | 1 |

| ANIX | 2 | 156 | 0 |

| ICBK | 3 | 5549 | 0 |

| VERY | 2 | 730 | 0 |

| CHRA | 4 | 27022 | 2 |

| MDWD | 4 | 7751 | 2 |

| Average | 3 | 9630 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $16 million in CBAN’s case. IMARA Inc. (NASDAQ:IMRA) is the most popular stock in this table. On the other hand Bogota Financial Corp. (NASDAQ:BSBK) is the least popular one with only 1 bullish hedge fund positions. Colony Bankcorp Inc (NASDAQ:CBAN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CBAN is 85. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still beat the market by 6.1 percentage points. Hedge funds were also right about betting on CBAN as the stock returned 13.8% since the end of Q1 (through 6/18) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Colony Bankcorp Inc (NASDAQ:CBAN)

Follow Colony Bankcorp Inc (NASDAQ:CBAN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.