Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the elite funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of HCA Holdings Inc (NYSE:HCA).

It’s worth mentioning that HCA Holdings Inc (NYSE:HCA) has experienced a decrease in enthusiasm from smart money during the third quarter. At the end of this article we will also compare HCA to other stocks including AFLAC Incorporated (NYSE:AFL), Canadian Imperial Bank of Commerce (USA) (NYSE:CM), and Waste Management, Inc. (NYSE:WM) to get a better sense of its popularity.

Follow Hca Healthcare Inc. (NYSE:HCA)

Follow Hca Healthcare Inc. (NYSE:HCA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Wichy/Shutterstock.com

With all of this in mind, let’s review the recent action surrounding HCA Holdings Inc (NYSE:HCA).

What does the smart money think about HCA Holdings Inc (NYSE:HCA)?

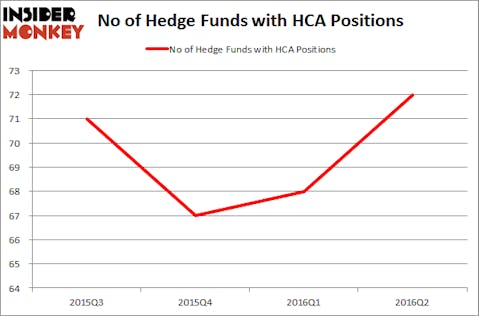

Heading into the fourth quarter of 2016, a total of 62 of the hedge funds tracked by Insider Monkey held long positions in this stock, down by 14% over the quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Larry Robbins’s Glenview Capital has the largest position in HCA Holdings Inc (NYSE:HCA), worth close to $1.2092 billion, corresponding to 8.6% of its total 13F portfolio. On Glenview Capital’s heels is Glenn Greenberg of Brave Warrior Capital, with a $189 million position; the fund has 9.1% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions include Daniel S. Och’s OZ Management, Anthony Bozza’s Lakewood Capital Management and Paul Reeder and Edward Shapiro’s PAR Capital Management.

Seeing as HCA Holdings Inc (NYSE:HCA) has witnessed bearish sentiment from the smart money, logic holds that there was a specific group of fund managers who sold off their full holdings by the end of the third quarter. Interestingly, Andreas Halvorsen’s Viking Global said goodbye to the biggest stake of the 700 funds followed by Insider Monkey, comprising close to $83.9 million in stock, and Robert Pohly’s Samlyn Capital was right behind this move, as the fund dumped about $49.1 million worth of shares. These transactions are important to note, as total hedge fund interest fell by 10 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to HCA Holdings Inc (NYSE:HCA). We will take a look at AFLAC Incorporated (NYSE:AFL), Canadian Imperial Bank of Commerce (USA) (NYSE:CM), Waste Management, Inc. (NYSE:WM), and The Blackstone Group L.P. (NYSE:BX). This group of stocks’ market valuations resemble HCA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFL | 29 | 508126 | 2 |

| CM | 18 | 286137 | 4 |

| WM | 34 | 2122045 | 0 |

| BX | 32 | 403795 | 0 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $830 million. That figure was $3.31 billion in HCA’s case. Waste Management, Inc. (NYSE:WM) is the most popular stock in this table with 34 funds holding long positions. On the other hand Canadian Imperial Bank of Commerce (USA) (NYSE:CM) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks HCA Holdings Inc (NYSE:HCA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.