Madison Investments, an investment advisor, released its “Madison Sustainable Equity Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. As measured by the S&P 500 Index, the markets were mixed in the third quarter. The fund returned -3.14% in the quarter compared to -3.27% return for the S&P 500 Index. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

Madison Sustainable Equity Fund highlighted stocks like Texas Instruments Incorporated (NASDAQ:TXN) in the third quarter 2023 investor letter. Headquartered in Dallas, Texas, Texas Instruments Incorporated (NASDAQ:TXN) designs and manufactures semiconductors. On October 25, 2023, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $141.79 per share. One-month return of Texas Instruments Incorporated (NASDAQ:TXN) was -10.34%, and its shares lost 10.19% of their value over the last 52 weeks. Texas Instruments Incorporated (NASDAQ:TXN) has a market capitalization of $128.774 billion.

Madison Sustainable Equity Fund made the following comment about Texas Instruments Incorporated (NASDAQ:TXN) in its Q3 2023 investor letter:

“We recently purchased a position in Texas Instruments Incorporated (NASDAQ:TXN). TI is a leading global supplier of analog and embedded semiconductors. In contrast to many digital semiconductor companies, TI’s products can remain in demand for decades and are thus less exposed to obsolescence or product cycle risk. TI’s chips also comprise a very low percentage of the total cost of the end product allowing the company to routinely generate margins and returns on capital in the top decile of the S&P 500. We believe increasing analog and embedded content growth in Automotive and Industrial will allow TI to grow at a faster pace than in the previous decade.”

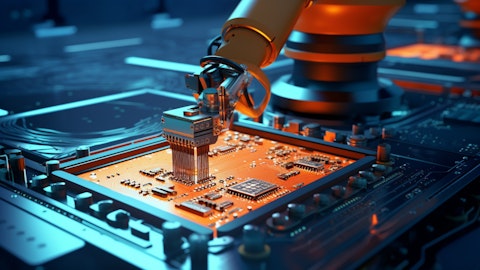

A technician looking at a circuit board of analog semiconductor products. Editorial photo for a financial news article. 8k. –ar 16:9

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 56 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of second quarter which was 52 in the previous quarter.

We discussed Texas Instruments Incorporated (NASDAQ:TXN) in another article and shared the list of best technology dividend stocks to buy. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 11 Best Dogs of the Dow Stocks Ranked By Hedge Fund Sentiment

- Top 10 Oil and Gas Stocks To Buy

- 12 Biggest Energy Drink Stocks in the US

Disclosure: None. This article is originally published at Insider Monkey.