Investment management company Vulcan Value Partners recently released its third quarter 2023 investor letter. A copy of the same can be downloaded here. The firm has five strategies, all delivering negative returns in the third quarter. The fund’s Large Cap Composite returned -4.2% net of fees and expenses, the Small Cap Composite returned -5.7% net, the Focus Composite returned -1.9% net, the Focus Plus composite returned -2.0%, and the All-Cap Composite returned -4.9% net. You can check the top 5 holdings of the fund to know its best picks in 2023.

Vulcan Value Partners highlighted stocks like Texas Instruments Incorporated (NASDAQ:TXN) in the third quarter 2023 investor letter. Headquartered in Dallas, Texas, Texas Instruments Incorporated (NASDAQ:TXN) designs and manufactures semiconductors. On October 13, 2023, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $152.75 per share. One-month return of Texas Instruments Incorporated (NASDAQ:TXN) was -6.19%, and its shares gained 1.17% of their value over the last 52 weeks. Texas Instruments Incorporated (NASDAQ:TXN) has a market capitalization of $138.692 billion.

Vulcan Value Partners made the following comment about Texas Instruments Incorporated (NASDAQ:TXN) in its Q3 2023 investor letter:

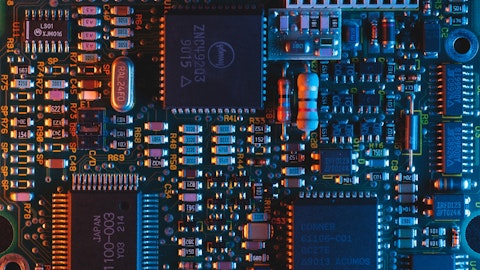

“Texas Instruments Incorporated (NASDAQ:TXN) is the world’s largest designer and manufacturer of analog semiconductors. These semiconductors convert real-world signals, such as temperature, pressure, and sound, into digital data. Analog semiconductors are also used to manage power in electronic devices. We are drawn to this company because its products are mission critical, and product cost as a percentage of total system cost is low. Moreover, market positions are stable over long periods of time and barriers to entry are high. Its management team thinks strategically, in terms of decades, and focuses on maximizing free cash flow per share over the long term.”

An automated manufacturing production line of semiconductor components on an assembly line. Editorial photo for a financial news article. 8k. –ar 16:9

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 56 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of second quarter which was 52 in the previous quarter.

We discussed Texas Instruments Incorporated (NASDAQ:TXN) in another article and shared the list of best October dividend stocks to buy. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Most Common Reasons You’re Likely to Get Fired

- 10 Smartphones with the Best Audio Quality

- Top 15 Bioplastics Companies in the World

Disclosure: None. This article is originally published at Insider Monkey.