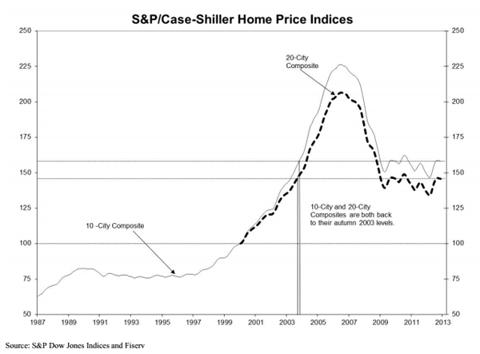

To prove the effect of inflation, prices of houses have started to recover for some time now.

The Fed will probably let the real estate industry growth continue for some time. With the US showing gradual growth in the natural energy and technology department, economic growth should spur in a few years, and then you can expect the mortgage rates to go up. In fact, recent news shows that mortgage rates have risen over the last week.

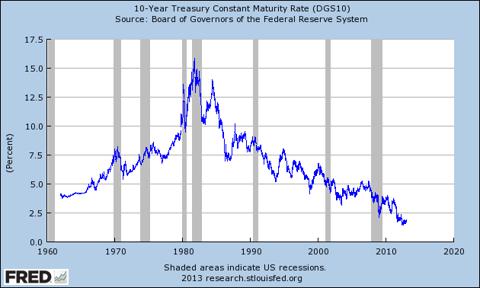

Regarding the interest rate, US treasury rates have been trading at the lowest rate since the 1960s. It peaked during the 1980s, but since then has been falling down to very low levels to bring up the economic growth.

With more money injected into the economy, the rate will go down. But most probably more money will just get shifted to the capital market, and thus drive Armor’s equity prices even higher. And don’t worry about the stock price going higher either (higher stock price means higher PER, right?). Higher mortgage payments on higher house prices and steady interest rates – funds flow from operations should increase for Armor Residential in the next couple of years, and that should keep the PER relatively low.

QE3, a rise in tax rates, apprehensive social welfare cuts – all these will keep the consumer confidence index down, and thus the interest rates down at the moment. The interest rates spike will further be moderated by the “yen tsunami” by the Bank of Japan. But they will reverse once US economic growth gets stabilized, inflation grows, or QE3 ends. until then, Armor Residential’s gross margin should grow.

Competitive Analysis

Armour Residential’s free cash flow from operations minus one-time gains or losses on property sales (a proxy for funds for operations) has increased over the last three years. Yes this might be due to the heavy purchase of agency MBS over the last three years, which has led to an interest income of $117.7 million in 2011, compared to $447,000 in 2009. This income will grow as average portfolio inventory increases and mortgage interest rates rise over time (note: the percentage of adjustable and hybrid adjustable securities in Armor Residential’s portfolio totals down to 53.35%, with 3.9% resettable within 3 years).

| Free Funds From Operations (FFO) | |

| 2009 | (2.6 million) |

| 2010 | $9 million |

| 2011 | $101.4 million |

Derivative trading has led to a realized loss of $25 million and an unrealized loss of $97 million in 2011, against a realized loss of $720 and an unrealized gain of $50,363 in 2009.

Here is an excerpt from the annual FY2011 statement:

“In addition, since we do not qualify to use cash flow hedge accounting, earnings reported in accordance with accounting principles generally accepted in the U.S. (“GAAP”) will fluctuate even in situations where our derivatives are operating as intended. As a result of this mark-to-market accounting treatment, our results of operations are likely to fluctuate far more than if we were able to designate our derivative activities as cash flow hedges. Comparisons with companies that are eligible to use cash flow hedge accounting for all or part of their derivative activities may not be meaningful.”