While rising mortgage rates increase the chance of higher revenue, higher leverage still concerns me in regards to ARMOUR Residential REIT, Inc. (NYSE:ARR). It is not a people’s favorite these days, as the monthly stock price graph shows–yet you have a “buy” rating from my end. With increasing stability in the housing market, a lower valuation, and improving fundamentals, the company might be worth a glance.

Company Profile

This excerpt is taken from the company website:

ARMOUR Residential REIT (NYSE:ARR), Inc. invests in hybrid adjustable rate, adjustable rate and fixed rate residential mortgage-backed securities issued by or guaranteed by U.S. Government agencies or U.S. Government sponsored entities such as:

1). Federal National Mortgage Association (Fannie Mae);

2). Federal Home Loan Mortgage Corporation, (Freddie Mac); and

3). Government National Mortgage Administration, (Ginnie Mae).

We are externally managed by ARMOUR Residential Management LLC.

The main source of income (over 75%) comes from regular mortgage payments, based on adjustable or fixed mortgage rates of interest from mortgage loan borrowers. They finance their investment in agency securities through external debt (or repurchase agreements). They qualify as a REIT, which means they incur tax-deductible income and are expected to distribute over 90% of their income and capital gains to their shareholders.

Market Analysis

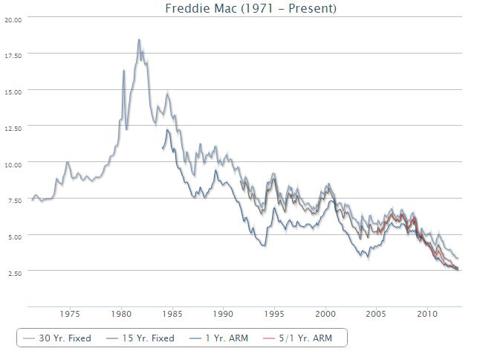

The most important risk that a mortgage REIT incurs is the interest rate spreads. Lower mortgage rates mean lower net income–higher interest rates mean higher costs of borrowing debt, leading to lower net income. It is the “sweet spot” in between that is craved by REIT investors.

The first thing to note is that average mortgage rates (whether it is due 1 year, 10 years, or 30 years) have already reached the bottom and can only go up from here. Take a look at the 40 year graph below:

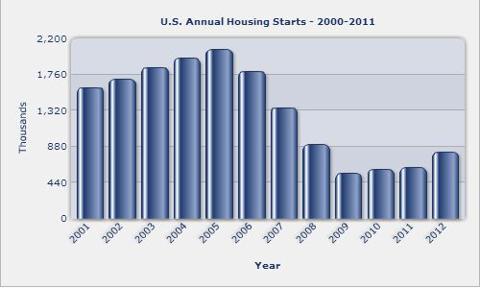

The interesting thing is, higher mortgage rates can lead to lower mortgage applications, and thus lower gross income. And that should show in declining new starts, right? Apparently, new starts have been going up consistently since 2010.

And although the consumer confidence index went down in January as a consequence of the higher tax rates, statistics say that it has been going up since 2010. If it grows at the current rate, it should reach the consumer confidence level of 2005 very soon. With a bit of doubt in the global economy, I will say that might take a couple of years–let’s say around 2014.

Increasing consumer confidence levels, coupled with increased housing starts, indicates that the housing industry is on its path to recovery. But is it acceptable that only the housing industry prospers while other industries (and most importantly the US government) lag behind? Although QE3 will keep the mortgage and interest rates down for some time, they will probably go up by 2015.

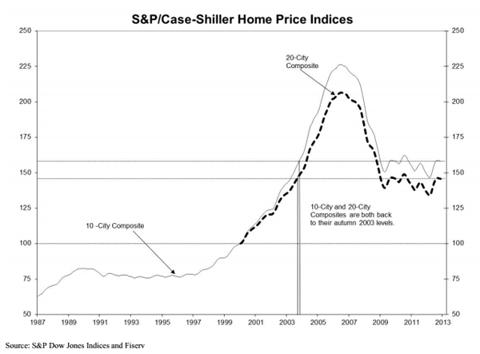

To prove the effect of inflation, prices of houses have started to recover for some time now.

The Fed will probably let the real estate industry growth continue for some time. With the US showing gradual growth in the natural energy and technology department, economic growth should spur in a few years, and then you can expect the mortgage rates to go up. In fact, recent news shows that mortgage rates have risen over the last week.

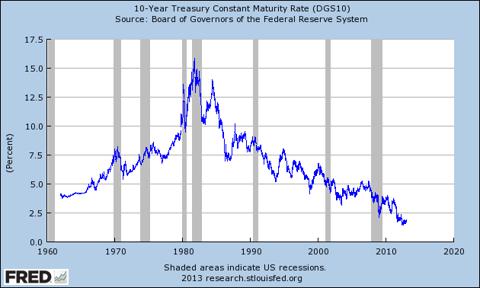

Regarding the interest rate, US treasury rates have been trading at the lowest rate since the 1960s. It peaked during the 1980s, but since then has been falling down to very low levels to bring up the economic growth.

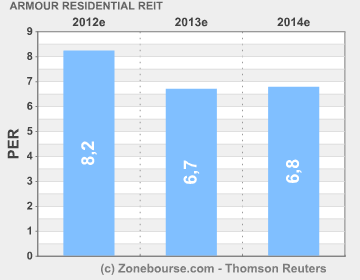

With more money injected into the economy, the rate will go down. But most probably more money will just get shifted to the capital market, and thus drive Armor’s equity prices even higher. And don’t worry about the stock price going higher either (higher stock price means higher PER, right?). Higher mortgage payments on higher house prices and steady interest rates – funds flow from operations should increase for Armor Residential in the next couple of years, and that should keep the PER relatively low.

QE3, a rise in tax rates, apprehensive social welfare cuts – all these will keep the consumer confidence index down, and thus the interest rates down at the moment. The interest rates spike will further be moderated by the “yen tsunami” by the Bank of Japan. But they will reverse once US economic growth gets stabilized, inflation grows, or QE3 ends. until then, Armor Residential’s gross margin should grow.

Competitive Analysis

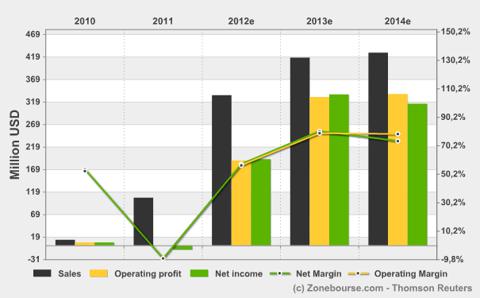

Armour Residential’s free cash flow from operations minus one-time gains or losses on property sales (a proxy for funds for operations) has increased over the last three years. Yes this might be due to the heavy purchase of agency MBS over the last three years, which has led to an interest income of $117.7 million in 2011, compared to $447,000 in 2009. This income will grow as average portfolio inventory increases and mortgage interest rates rise over time (note: the percentage of adjustable and hybrid adjustable securities in Armor Residential’s portfolio totals down to 53.35%, with 3.9% resettable within 3 years).

| Free Funds From Operations (FFO) | |

| 2009 | (2.6 million) |

| 2010 | $9 million |

| 2011 | $101.4 million |

Derivative trading has led to a realized loss of $25 million and an unrealized loss of $97 million in 2011, against a realized loss of $720 and an unrealized gain of $50,363 in 2009.

Here is an excerpt from the annual FY2011 statement:

“In addition, since we do not qualify to use cash flow hedge accounting, earnings reported in accordance with accounting principles generally accepted in the U.S. (“GAAP”) will fluctuate even in situations where our derivatives are operating as intended. As a result of this mark-to-market accounting treatment, our results of operations are likely to fluctuate far more than if we were able to designate our derivative activities as cash flow hedges. Comparisons with companies that are eligible to use cash flow hedge accounting for all or part of their derivative activities may not be meaningful.”

Cash flow hedges are simply hedges, the gain or loss of which are not reported in the income statement until the forecasted transaction occurs. As the company is not qualified for hedge accounting, they use these derivative instruments on a non-designated basis, and thus the volatility in the gains and losses on the instruments are reported on the income statement. But notably, the company is hedging a lot these days. And losing market value in the derivatives might say that derivative assets are getting eroded over time, for which realized losses might increase over time.

Having said that, total realized plus unrealized losses on derivatives were recorded at $50.4 million in Q3FY2012, compared to $74.3 million in Q3FY11 and $3.6 million in Q3FY10.

The interest rate spread has decreased 2.05% in 2011 from 3.87% in 2009. With the recent QE3 and rising mortgage rates, the interest spread rate might improve this year. Average portfolio yield decreased to 3% in 2011, as compared to 4.59% in 2009. This is good, keeping in mind that the portfolio value might be increasing over time. In addition to that, repurchase agreements reached $5.2 billion in Q3FY12, compared to $971.7 million in Q3FY11. With a current ratio of 0.1, I am counting on increased funds flow from operations in the next few quarters to deal with that large amount of liability.

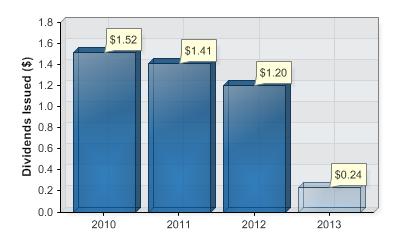

One thing I am absolutely disappointed to see is that while the dividend per share is tanking, management and compensation fees reached around $6 million in Q3FY12.

Now let’s take a look at how Armor Residential is doing in comparison with the competition.

Disclaimer: Ratios and numbers can differ according to different sites. But when used comparatively, they should meaningfully show the financial standing of the company against that of the rest.

Valuation – With the stock price declining over 8% in the last 6 months, Armor Residential is trading at a medium-valued level. While the PE ratio is expected to fall in the next couple of years, you might want to wait a bit before putting your money in.

Efficiency – The asset turnover ratio (a proxy for portfolio yield) of 0.03 is not much below the 0.04 of American Capital Agency Corp. (NASDAQ:AGNC) and 0.05 of MFA Financial, Inc. (NYSE:MFA).

Profitability – A gross margin (a proxy for net interest income margin) at 89.92% is pretty high in comparison with the rest. Perhaps the interest spread, acquired by Armor Residential, is much better than the rest.

Leverage – With total debt/equity ratio at 851.57 and a current ratio of 0.1, the high leverage factor increases a lot of risk in terms of future cash flows. If the portfolio yield is not properly managed, this can eat into the shareholders’ equity. While revenue (coupled with operating and net margin) is expected to increase, high leverage should not be a problem. On a side note, if gross margin can be improved with a bit of leverage, then it’s good. For example, Invesco Mortgage Capital Inc (NYSE:IVR)‘s gross margin might improve with a bit of leverage.

Risk -The low beta of 0.22 tells me that the management is taking the cautious route here. While the whole real estate industry is just recovering, the low beta assures me of some safety at least.

Conclusion

It might not be a good time to buy the company, but it definitely is time to start following the regular movements of the stock. With a recovering housing industry, improving fundamentals, and still lower valuations, this might turn out to be a value stock in a few years.

And as they say, you make profit when you buy, not when you sell. So stay tuned to this company.

Source: Q3FY12 report, Google Finance, Yahoo Finance and multiple other sites.

The article What I Think Of ARMOUR Residential REIT originally appeared on Fool.com and is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.