While rising mortgage rates increase the chance of higher revenue, higher leverage still concerns me in regards to ARMOUR Residential REIT, Inc. (NYSE:ARR). It is not a people’s favorite these days, as the monthly stock price graph shows–yet you have a “buy” rating from my end. With increasing stability in the housing market, a lower valuation, and improving fundamentals, the company might be worth a glance.

Company Profile

This excerpt is taken from the company website:

ARMOUR Residential REIT (NYSE:ARR), Inc. invests in hybrid adjustable rate, adjustable rate and fixed rate residential mortgage-backed securities issued by or guaranteed by U.S. Government agencies or U.S. Government sponsored entities such as:

1). Federal National Mortgage Association (Fannie Mae);

2). Federal Home Loan Mortgage Corporation, (Freddie Mac); and

3). Government National Mortgage Administration, (Ginnie Mae).

We are externally managed by ARMOUR Residential Management LLC.

The main source of income (over 75%) comes from regular mortgage payments, based on adjustable or fixed mortgage rates of interest from mortgage loan borrowers. They finance their investment in agency securities through external debt (or repurchase agreements). They qualify as a REIT, which means they incur tax-deductible income and are expected to distribute over 90% of their income and capital gains to their shareholders.

Market Analysis

The most important risk that a mortgage REIT incurs is the interest rate spreads. Lower mortgage rates mean lower net income–higher interest rates mean higher costs of borrowing debt, leading to lower net income. It is the “sweet spot” in between that is craved by REIT investors.

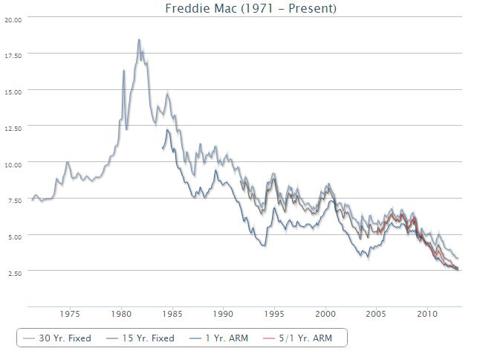

The first thing to note is that average mortgage rates (whether it is due 1 year, 10 years, or 30 years) have already reached the bottom and can only go up from here. Take a look at the 40 year graph below:

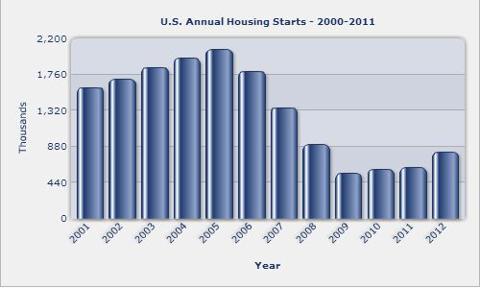

The interesting thing is, higher mortgage rates can lead to lower mortgage applications, and thus lower gross income. And that should show in declining new starts, right? Apparently, new starts have been going up consistently since 2010.

And although the consumer confidence index went down in January as a consequence of the higher tax rates, statistics say that it has been going up since 2010. If it grows at the current rate, it should reach the consumer confidence level of 2005 very soon. With a bit of doubt in the global economy, I will say that might take a couple of years–let’s say around 2014.

Increasing consumer confidence levels, coupled with increased housing starts, indicates that the housing industry is on its path to recovery. But is it acceptable that only the housing industry prospers while other industries (and most importantly the US government) lag behind? Although QE3 will keep the mortgage and interest rates down for some time, they will probably go up by 2015.