Sohn Conference is my favorite hedge fund event. I haven’t missed an event since 2013. This doesn’t mean that every stock pitched at the conference is a great investment opportunity and will beat its benchmark. A few weeks ago we took a look at the performance of the stocks pitched at the 2018 Sohn Conference and found that these stocks outperformed their benchmarks by 3.2 percentage points.

We got pitched more than a dozen investment ideas in 2018. We didn’t tell our subscribers to invest equal amounts in each of those picks. Who does that anyway? A rational investor listens to all of these ideas, identifies a few promising ones, does his/her in-depth analysis, and then decides to pull the trigger on maybe 1 or 2 of these ideas. That’s what I did. One idea particularly stood at for me. I spent a few weeks analyzing that idea and decided to recommend it in our monthly newsletter. Our monthly newsletter tries to identify the “best stock picks of the best hedge fund managers”. We launched this strategy a little bit over 2 years ago and our stock picks managed to return 64% and beat the S&P 500 Index by nearly 40 percentage points.

How did we do it? By identifying the best stock picks of the best hedge fund managers. Guess which stock we recommended from the 2018 Sohn New York Conference? Ascendis Pharma (ASND). The stock was trading around $63 at time of Oleg Nodelman‘s presentation. By the time I recommended it and our subscribers had time to buy the stock, the share price increased to $65. The stock’s price didn’t move much for several months.

I usually don’t give away my best stock idea but once a year we run a promotion and I give something valuable back to the subscribers who are powering Insider Monkey. Last October we published a free special issue of our monthly newsletter and send our 160,000 subscribers an email with the title “My #1 Top-Ranked Stock in the World”. You can still download the sample issue here.

My “#1 top-ranked stock” in October was Ascendis Pharma (NASDAQ:ASND). It was trading at $63 at the time. Today, it is at $122. Investors who read our free report and bought the stock in the following few weeks returned more than 90% in 6 short months.

We are going share this year’s best investment idea again in the May 2019 issue of our monthly newsletter. If you subscribe to our monthly newsletter and aren’t satisfied with the performance of our stock pick in a year, I will refund your payment.

Below I am going to provide a complete recap of this year’s presentations. You can try to identify this year’s best idea by yourself or you can subscribe to our monthly newsletter and read a fully transcribed version of the presentation.

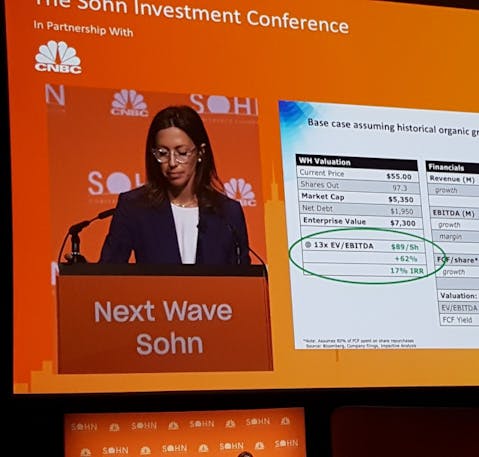

Next Wave: This is the part of the Sohn Conference where less known fund managers present their stock pitches. I usually like this portion of the Sohn Conference better because these “newer” fund managers try to build a name for themselves are more likely to present their absolute best ideas.

9:05 Lauren Taylor Wolfe, Managing Partner, Impactive Capital LP: The details of this presentation was shared here.

9:20 Todd Westhus, Founding Partner, Chief Investment Officer, Olympus Peak Asset Management LP: Todd Westhus is the founder and CIO of Olympus Peak Asset Management. Westhus was a managing partner at Perry Capital focusing on credit and special situations between 2006 and 2017. Before Perry Capital Westhus cut his teeth at Avenue Capital Group working on distressed opportunities in troubled industries such as airlines, automotive, chemicals, paper and packaging, and gaming. Todd has a B.A. in economics and biology from Duke University.

Idea: Short in unsecured Western Digital Corporation (NASDAQ:WDC) bonds hedged by a long position in senior secured bank debt. This isn’t a practical idea for ordinary investors. The underlying investment thesis relies on a deterioration in Western Digital’s financial condition. So, we will use a short position in WDC as a proxy to determine the success level of this thesis.

Benchmark: Short position in S&P 500 ETF (NYSE:SPY).

Thesis: “Both cyclical and secular forces are working against the company. In our opinion the best to express this negative thesis towards Western Digital is not to outright short the equity but rather to have a long short position elsewhere in the capital structure. We are long senior secured bank debt ( trading for 99% of par) and short unsecured bonds (trading for 97% of par)” said Westhus. Basically Westhus is using a credit bet which has a maximum downside of 2% to bet that Western Digital shares will go down dramatically. This way if he is wrong his maximum loss would be only 2% whereas he can still generate double digit returns if WDC shares decline dramatically. Westhus believes Western Digital’s HDD business is under the threat of SSD. Half of Western Digital’s business is HDD and the other is SSD but they are a smaller player in the SSD market where prices have been collapsing over the last 5 quarters (they fell 25% last quarter alone). Inventory levels are at historically high levels and continue to increase. Westhus thinks we are about to see the effects of this on WDC shortly through even more declines in SSD prices which will shrink WDC’s gross profit margin to zero (currently it is at 21%). The fundamentals of the stock are moving in the opposite direction of WDC’s stock price and this can’t go on forever and sets up well for negative bet against the company which operates in a very volatile industry. WDC lost 50% of its SSD market share over the last 5 years, so competition is fierce in this segment. Westhus also said that Western Digital has the worst balance sheet in the industry and its cash balance is declining quickly (currently at 50% of its 2017 level). In short, Westhus believes Western Digital is managing a “melting ice cube business” and making expensive and unsuccessful acquisitions to counter this. To make the matters worse Westhus expects China to start investing heavily in this industry which means the future of this industry is bleak in terms of high prices and profit margins.

You can read the summary of other presentations on this page.

Disclosure: I have a very old long position in S&P 500 ETF that I am not selling due to tax reasons. This article is originally published at Insider Monkey.