Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Midland States Bancorp, Inc. (NASDAQ:MSBI) based on that data.

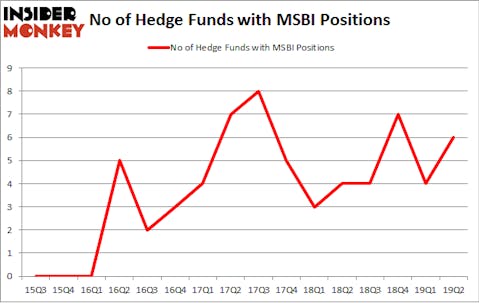

Is Midland States Bancorp, Inc. (NASDAQ:MSBI) a healthy stock for your portfolio? The smart money is becoming hopeful. The number of long hedge fund bets moved up by 2 in recent months. Our calculations also showed that MSBI isn’t among the 30 most popular stocks among hedge funds (see the video below). MSBI was in 6 hedge funds’ portfolios at the end of June. There were 4 hedge funds in our database with MSBI holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are several metrics stock traders can use to value stocks. A couple of the best metrics are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outpace their index-focused peers by a very impressive amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the fresh hedge fund action encompassing Midland States Bancorp, Inc. (NASDAQ:MSBI).

How have hedgies been trading Midland States Bancorp, Inc. (NASDAQ:MSBI)?

At Q2’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards MSBI over the last 16 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Midland States Bancorp, Inc. (NASDAQ:MSBI), with a stake worth $1.5 million reported as of the end of March. Trailing Renaissance Technologies was Ancora Advisors, which amassed a stake valued at $0.7 million. Citadel Investment Group, Zebra Capital Management, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, initiated the biggest position in Midland States Bancorp, Inc. (NASDAQ:MSBI). Citadel Investment Group had $0.4 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.2 million position during the quarter.

Let’s check out hedge fund activity in other stocks similar to Midland States Bancorp, Inc. (NASDAQ:MSBI). We will take a look at KNOT Offshore Partners LP (NYSE:KNOP), Kimball International Inc (NASDAQ:KBAL), Dorchester Minerals LP (NASDAQ:DMLP), and The Manitowoc Company, Inc. (NYSE:MTW). This group of stocks’ market valuations are closest to MSBI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KNOP | 5 | 18106 | 1 |

| KBAL | 13 | 108992 | 1 |

| DMLP | 7 | 40466 | 1 |

| MTW | 13 | 110489 | -7 |

| Average | 9.5 | 69513 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $3 million in MSBI’s case. Kimball International Inc (NASDAQ:KBAL) is the most popular stock in this table. On the other hand KNOT Offshore Partners LP (NYSE:KNOP) is the least popular one with only 5 bullish hedge fund positions. Midland States Bancorp, Inc. (NASDAQ:MSBI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MSBI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MSBI investors were disappointed as the stock returned -1.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.