At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards BlackLine, Inc. (NASDAQ:BL) at the end of the first quarter and determine whether the smart money was really smart about this stock.

Is BlackLine, Inc. (NASDAQ:BL) a good investment now? The smart money was getting more optimistic. The number of long hedge fund positions rose by 1 lately. Our calculations also showed that BL isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). BL was in 18 hedge funds’ portfolios at the end of the first quarter of 2020. There were 17 hedge funds in our database with BL positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

We previously covered Ensemble Capital’s long thesis towards Blackline in this article. “With a 97% customer retention rate and about 110% revenue retention rate, the company’s software is clearly very sticky. But this is a young market and Blackline is the leader, so growth is an important value creation goal. As a result, it rationally invests heavily in sales marketing and R&D to both acquire new customers and grow its footprint of products within its customer base” Ensemble said about the company. Small hedge fund Andvari Associates was also bullish about the stock which we covered in this article.

Philip Hempleman of Ardsley Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Cannabis stocks are roaring back in 2020, so we are checking out this under-the-radar stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Now let’s take a peek at the fresh hedge fund action regarding BlackLine, Inc. (NASDAQ:BL).

What does smart money think about BlackLine, Inc. (NASDAQ:BL)?

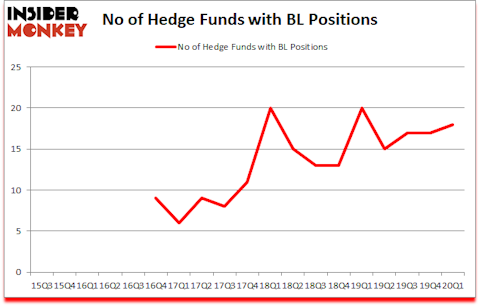

Heading into the second quarter of 2020, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in BL over the last 18 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, D E Shaw, managed by D. E. Shaw, holds the largest position in BlackLine, Inc. (NASDAQ:BL). D E Shaw has a $95.7 million position in the stock, comprising 0.1% of its 13F portfolio. On D E Shaw’s heels is Stephen Perkins of Toronado Partners, with a $30.3 million position; the fund has 9.5% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish include John Overdeck and David Siegel’s Two Sigma Advisors, Barry Lebovits and Joshua Kuntz’s Rivulet Capital and Derek C. Schrier’s Indaba Capital Management. In terms of the portfolio weights assigned to each position Toronado Partners allocated the biggest weight to BlackLine, Inc. (NASDAQ:BL), around 9.47% of its 13F portfolio. Indaba Capital Management is also relatively very bullish on the stock, setting aside 3.24 percent of its 13F equity portfolio to BL.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Rivulet Capital, managed by Barry Lebovits and Joshua Kuntz, initiated the biggest position in BlackLine, Inc. (NASDAQ:BL). Rivulet Capital had $6.4 million invested in the company at the end of the quarter. Derek C. Schrier’s Indaba Capital Management also made a $6 million investment in the stock during the quarter. The other funds with new positions in the stock are Mark Coe’s Intrinsic Edge Capital, George McCabe’s Portolan Capital Management, and Greg Eisner’s Engineers Gate Manager.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as BlackLine, Inc. (NASDAQ:BL) but similarly valued. These stocks are Texas Pacific Land Trust (NYSE:TPL), Wyndham Hotels & Resorts, Inc. (NYSE:WH), Valley National Bancorp (NYSE:VLY), and Perspecta Inc. (NYSE:PRSP). All of these stocks’ market caps resemble BL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPL | 14 | 694383 | -3 |

| WH | 31 | 501047 | -13 |

| VLY | 22 | 24789 | -2 |

| PRSP | 32 | 326939 | -14 |

| Average | 24.75 | 386790 | -8 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $387 million. That figure was $176 million in BL’s case. Perspecta Inc. (NYSE:PRSP) is the most popular stock in this table. On the other hand Texas Pacific Land Trust (NYSE:TPL) is the least popular one with only 14 bullish hedge fund positions. BlackLine, Inc. (NASDAQ:BL) is not the least popular stock in this group but hedge fund interest is still below average. Our hedge fund sentiment chart shows that hedge fund sentiment towards Blackline is improving though. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 18.6% in 2020 through July 27th and still beat the market by 17.1 percentage points. A small number of hedge funds were also right about betting on BL as the stock returned 64.7% since the end of March and outperformed the market by an even larger margin.

Follow Blackline Inc. (NASDAQ:BL)

Follow Blackline Inc. (NASDAQ:BL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.