“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 835 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2019. In this article we are going to take a look at smart money sentiment towards Veoneer, Inc. (NYSE:VNE).

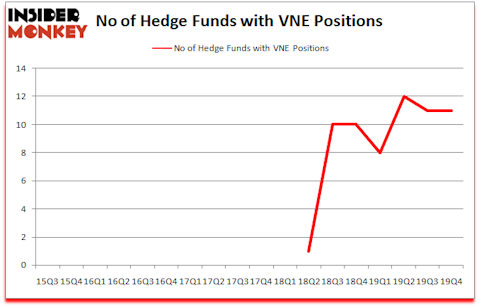

Hedge fund interest in Veoneer, Inc. (NYSE:VNE) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as The Cheesecake Factory Incorporated (NASDAQ:CAKE), Heartland Express, Inc. (NASDAQ:HTLD), and Merit Medical Systems, Inc. (NASDAQ:MMSI) to gather more data points. Our calculations also showed that VNE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Christer Gardell of Cevian Capital

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a glance at the key hedge fund action encompassing Veoneer, Inc. (NYSE:VNE).

What have hedge funds been doing with Veoneer, Inc. (NYSE:VNE)?

Heading into the first quarter of 2020, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VNE over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Cevian Capital was the largest shareholder of Veoneer, Inc. (NYSE:VNE), with a stake worth $125.3 million reported as of the end of September. Trailing Cevian Capital was Citadel Investment Group, which amassed a stake valued at $11.3 million. Millennium Management, Balyasny Asset Management, and 13D Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Cevian Capital allocated the biggest weight to Veoneer, Inc. (NYSE:VNE), around 20.6% of its 13F portfolio. HighVista Strategies is also relatively very bullish on the stock, earmarking 0.62 percent of its 13F equity portfolio to VNE.

Judging by the fact that Veoneer, Inc. (NYSE:VNE) has faced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few fund managers that elected to cut their positions entirely last quarter. Intriguingly, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. dropped the biggest stake of all the hedgies watched by Insider Monkey, totaling about $6.7 million in stock, and Highbridge Capital Management was right behind this move, as the fund said goodbye to about $6.6 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Veoneer, Inc. (NYSE:VNE). These stocks are The Cheesecake Factory Incorporated (NASDAQ:CAKE), Heartland Express, Inc. (NASDAQ:HTLD), Merit Medical Systems, Inc. (NASDAQ:MMSI), and ICF International Inc (NASDAQ:ICFI). This group of stocks’ market values are similar to VNE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAKE | 27 | 87474 | 3 |

| HTLD | 14 | 22928 | -4 |

| MMSI | 17 | 80551 | 0 |

| ICFI | 11 | 29456 | 0 |

| Average | 17.25 | 55102 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $55 million. That figure was $151 million in VNE’s case. The Cheesecake Factory Incorporated (NASDAQ:CAKE) is the most popular stock in this table. On the other hand ICF International Inc (NASDAQ:ICFI) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Veoneer, Inc. (NYSE:VNE) is even less popular than ICFI. Hedge funds dodged a bullet by taking a bearish stance towards VNE. Our calculations showed that the top 20 most popular hedge fund stocks returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but managed to beat the market by 4.2 percentage points. Unfortunately VNE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); VNE investors were disappointed as the stock returned -52.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.