Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost more than 25%. Facebook, which was the second most popular stock, lost 20% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the first 2.5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Hedge fund interest in Veoneer, Inc. (NYSE:VNE) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare VNE to other stocks including SendGrid, Inc. (NYSE:SEND), Iridium Communications Inc. (NASDAQ:IRDM), and Cactus, Inc. (NYSE:WHD) to get a better sense of its popularity.

At the moment there are numerous indicators stock traders employ to size up publicly traded companies. A pair of the most innovative indicators are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best fund managers can beat the market by a very impressive margin (see the details here).

Let’s take a gander at the key hedge fund action surrounding Veoneer, Inc. (NYSE:VNE).

What have hedge funds been doing with Veoneer, Inc. (NYSE:VNE)?

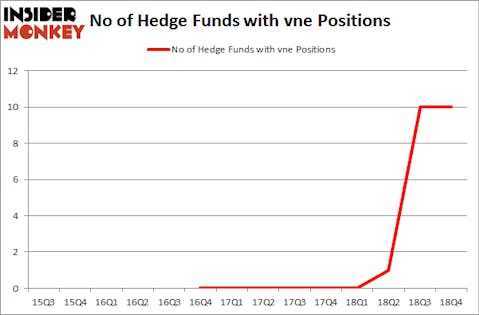

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards VNE over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, Cevian Capital held the most valuable stake in Veoneer, Inc. (NYSE:VNE), which was worth $134.9 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $29.5 million worth of shares. Moreover, Ulysses Management, Millennium Management, and GLG Partners were also bullish on Veoneer, Inc. (NYSE:VNE), allocating a large percentage of their portfolios to this stock.

Due to the fact that Veoneer, Inc. (NYSE:VNE) has experienced a decline in interest from hedge fund managers, we can see that there were a few hedge funds that elected to cut their entire stakes in the third quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management dumped the largest stake of the 700 funds followed by Insider Monkey, totaling about $20.8 million in call options. Seth Wunder’s fund, Black-and-White Capital, also said goodbye to its call options, about $4.4 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Veoneer, Inc. (NYSE:VNE). These stocks are SendGrid, Inc. (NYSE:SEND), Iridium Communications Inc. (NASDAQ:IRDM), Cactus, Inc. (NYSE:WHD), and Travelport Worldwide Ltd (NYSE:TVPT). This group of stocks’ market valuations are similar to VNE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SEND | 26 | 366686 | 6 |

| IRDM | 13 | 112828 | 2 |

| WHD | 18 | 160146 | 1 |

| TVPT | 24 | 458103 | 1 |

| Average | 20.25 | 274441 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $274 million. That figure was $183 million in VNE’s case. SendGrid, Inc. (NYSE:SEND) is the most popular stock in this table. On the other hand Iridium Communications Inc. (NASDAQ:IRDM) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Veoneer, Inc. (NYSE:VNE) is even less popular than IRDM. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on VNE, though not to the same extent, as the stock returned 23.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.