Is Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

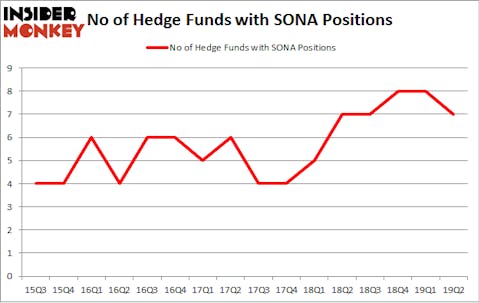

Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA) investors should be aware of a decrease in hedge fund sentiment in recent months. SONA was in 7 hedge funds’ portfolios at the end of the second quarter of 2019. There were 8 hedge funds in our database with SONA positions at the end of the previous quarter. Our calculations also showed that SONA isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are many signals stock traders use to assess publicly traded companies. Two of the most underrated signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite money managers can outclass their index-focused peers by a solid margin (see the details here).

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. Let’s take a look at the key hedge fund action encompassing Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA).

What have hedge funds been doing with Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA)?

At the end of the second quarter, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SONA over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA), which was worth $8.8 million at the end of the second quarter. On the second spot was Royce & Associates which amassed $6.7 million worth of shares. Moreover, Basswood Capital, Cove Street Capital, and D E Shaw were also bullish on Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA), allocating a large percentage of their portfolios to this stock.

Seeing as Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of funds that slashed their full holdings by the end of the second quarter. Intriguingly, Ken Griffin’s Citadel Investment Group dropped the largest position of the 750 funds monitored by Insider Monkey, comprising an estimated $0.3 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund sold off about $0.3 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 1 funds by the end of the second quarter.

Let’s also examine hedge fund activity in other stocks similar to Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA). These stocks are Gladstone Investment Corporation (NASDAQ:GAIN), AVROBIO, Inc. (NASDAQ:AVRO), Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN), and AC Immune SA (NASDAQ:ACIU). This group of stocks’ market valuations are similar to SONA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GAIN | 4 | 1798 | -3 |

| AVRO | 9 | 54946 | 5 |

| ACHN | 14 | 63433 | 0 |

| ACIU | 7 | 61527 | -2 |

| Average | 8.5 | 45426 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $45 million. That figure was $21 million in SONA’s case. Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) is the most popular stock in this table. On the other hand Gladstone Investment Corporation (NASDAQ:GAIN) is the least popular one with only 4 bullish hedge fund positions. Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SONA wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); SONA investors were disappointed as the stock returned 1.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.