“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

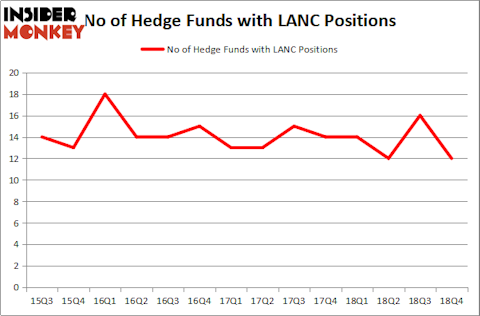

Lancaster Colony Corporation (NASDAQ:LANC) was in 12 hedge funds’ portfolios at the end of the fourth quarter of 2018. LANC has seen a decrease in activity from the world’s largest hedge funds in recent months. There were 16 hedge funds in our database with LANC holdings at the end of the previous quarter. Our calculations also showed that LANC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the key hedge fund action surrounding Lancaster Colony Corporation (NASDAQ:LANC).

How have hedgies been trading Lancaster Colony Corporation (NASDAQ:LANC)?

Heading into the first quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from one quarter earlier. On the other hand, there were a total of 14 hedge funds with a bullish position in LANC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Lancaster Colony Corporation (NASDAQ:LANC) was held by Renaissance Technologies, which reported holding $123.2 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $72.9 million position. Other investors bullish on the company included AQR Capital Management, Royce & Associates, and GLG Partners.

Since Lancaster Colony Corporation (NASDAQ:LANC) has faced falling interest from the smart money, it’s safe to say that there exists a select few funds who sold off their positions entirely last quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dropped the largest stake of all the hedgies watched by Insider Monkey, comprising about $6.7 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund sold off about $1.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 4 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Lancaster Colony Corporation (NASDAQ:LANC). We will take a look at Algonquin Power & Utilities Corp. (NYSE:AQN), New Residential Investment Corp (NYSE:NRZ), The Chemours Company (NYSE:CC), and EQT Corporation (NYSE:EQT). All of these stocks’ market caps resemble LANC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AQN | 9 | 24529 | 3 |

| NRZ | 25 | 144361 | 9 |

| CC | 28 | 496631 | -3 |

| EQT | 44 | 1317248 | -1 |

| Average | 26.5 | 495692 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $496 million. That figure was $258 million in LANC’s case. EQT Corporation (NYSE:EQT) is the most popular stock in this table. On the other hand Algonquin Power & Utilities Corp. (NYSE:AQN) is the least popular one with only 9 bullish hedge fund positions. Lancaster Colony Corporation (NASDAQ:LANC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately LANC wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); LANC investors were disappointed as the stock returned -13.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.