Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

ICU Medical, Inc. (NASDAQ:ICUI) shareholders have witnessed a decrease in support from the world’s most elite money managers of late. Our calculations also showed that icui isn’t among the 30 most popular stocks among hedge funds.

Today there are a lot of methods shareholders have at their disposal to appraise their stock investments. A pair of the most useful methods are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the best fund managers can trounce the broader indices by a very impressive margin (see the details here).

Cliff Asness of AQR Capital Management

We’re going to go over the latest hedge fund action encompassing ICU Medical, Inc. (NASDAQ:ICUI).

How are hedge funds trading ICU Medical, Inc. (NASDAQ:ICUI)?

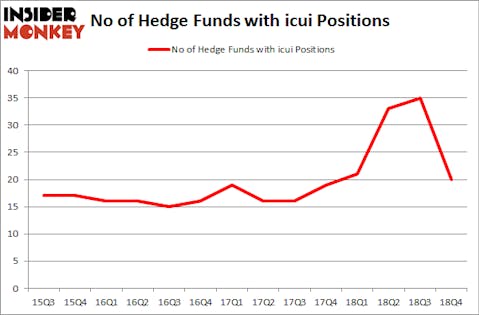

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -43% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ICUI over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of ICU Medical, Inc. (NASDAQ:ICUI), with a stake worth $87.6 million reported as of the end of September. Trailing AQR Capital Management was Millennium Management, which amassed a stake valued at $64.1 million. Partner Fund Management, Redmile Group, and Marshall Wace LLP were also very fond of the stock, giving the stock large weights in their portfolios.

Since ICU Medical, Inc. (NASDAQ:ICUI) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there exists a select few funds that slashed their entire stakes in the third quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management cut the largest investment of the “upper crust” of funds watched by Insider Monkey, worth about $47.3 million in stock. Brian Ashford-Russell and Tim Woolley’s fund, Polar Capital, also cut its stock, about $30.6 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 15 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to ICU Medical, Inc. (NASDAQ:ICUI). We will take a look at NewMarket Corporation (NYSE:NEU), Six Flags Entertainment Corp (NYSE:SIX), Casey’s General Stores, Inc. (NASDAQ:CASY), and IDACORP Inc (NYSE:IDA). This group of stocks’ market caps are similar to ICUI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEU | 16 | 64634 | 3 |

| SIX | 23 | 720468 | -2 |

| CASY | 18 | 55523 | 0 |

| IDA | 20 | 226667 | 9 |

| Average | 19.25 | 266823 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $267 million. That figure was $328 million in ICUI’s case. Six Flags Entertainment Corp (NYSE:SIX) is the most popular stock in this table. On the other hand NewMarket Corporation (NYSE:NEU) is the least popular one with only 16 bullish hedge fund positions. ICU Medical, Inc. (NASDAQ:ICUI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately ICUI wasn’t in this group. Hedge funds that bet on ICUI were disappointed as the stock returned 1.7% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.