“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards C&J Energy Services, Inc (NYSE:CJ) and see how it was affected.

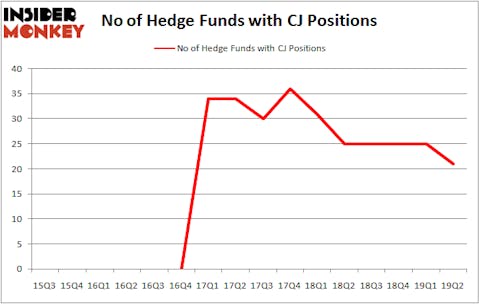

C&J Energy Services, Inc (NYSE:CJ) was in 21 hedge funds’ portfolios at the end of the second quarter of 2019. CJ has experienced a decrease in activity from the world’s largest hedge funds recently. There were 25 hedge funds in our database with CJ positions at the end of the previous quarter. Our calculations also showed that CJ isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the latest hedge fund action regarding C&J Energy Services, Inc (NYSE:CJ).

What have hedge funds been doing with C&J Energy Services, Inc (NYSE:CJ)?

At Q2’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -16% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CJ over the last 16 quarters. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Pzena Investment Management, managed by Richard S. Pzena, holds the biggest position in C&J Energy Services, Inc (NYSE:CJ). Pzena Investment Management has a $35.4 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund is Renaissance Technologies, with a $20.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism contain Matthew Barrett’s Glendon Capital Management, Israel Englander’s Millennium Management and Andy Redleaf’s Whitebox Advisors.

Due to the fact that C&J Energy Services, Inc (NYSE:CJ) has experienced declining sentiment from the aggregate hedge fund industry, we can see that there lies a certain “tier” of hedgies who sold off their entire stakes last quarter. At the top of the heap, Thomas E. Claugus’s GMT Capital dropped the largest investment of all the hedgies tracked by Insider Monkey, valued at about $14.6 million in stock, and Christopher Pucillo’s Solus Alternative Asset Management was right behind this move, as the fund cut about $2.2 million worth. These moves are important to note, as total hedge fund interest dropped by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to C&J Energy Services, Inc (NYSE:CJ). These stocks are Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA), INTL Fcstone Inc (NASDAQ:INTL), Bryn Mawr Bank Corp. (NASDAQ:BMTC), and Johnson Outdoors Inc. (NASDAQ:JOUT). All of these stocks’ market caps are closest to CJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KNSA | 9 | 77379 | -1 |

| INTL | 11 | 84299 | -4 |

| BMTC | 9 | 35889 | -1 |

| JOUT | 10 | 61163 | -1 |

| Average | 9.75 | 64683 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $155 million in CJ’s case. INTL Fcstone Inc (NASDAQ:INTL) is the most popular stock in this table. On the other hand Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks C&J Energy Services, Inc (NYSE:CJ) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CJ wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CJ were disappointed as the stock returned -8.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.