“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Is Avangrid, Inc. (NYSE:AGR) ready to rally soon? The smart money is taking a pessimistic view. The number of long hedge fund bets went down by 5 lately. Our calculations also showed that AGR isn’t among the 30 most popular stocks among hedge funds. AGR was in 13 hedge funds’ portfolios at the end of December. There were 18 hedge funds in our database with AGR holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action encompassing Avangrid, Inc. (NYSE:AGR).

How have hedgies been trading Avangrid, Inc. (NYSE:AGR)?

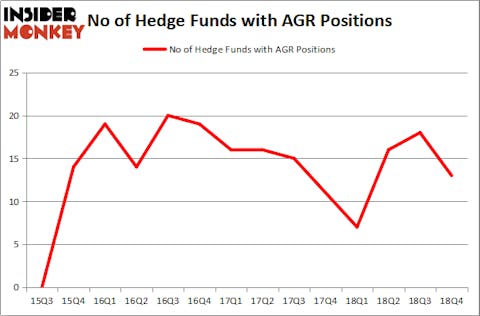

At Q4’s end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -28% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in AGR over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Richard S. Pzena’s Pzena Investment Management has the most valuable position in Avangrid, Inc. (NYSE:AGR), worth close to $107.3 million, corresponding to 0.6% of its total 13F portfolio. On Pzena Investment Management’s heels is Jos Shaver of Electron Capital Partners, with a $76.5 million position; 10% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions contain Jim Simons’s Renaissance Technologies, Noam Gottesman’s GLG Partners and Cliff Asness’s AQR Capital Management.

Seeing as Avangrid, Inc. (NYSE:AGR) has experienced declining sentiment from hedge fund managers, it’s safe to say that there is a sect of hedge funds that elected to cut their full holdings heading into Q3. It’s worth mentioning that Zilvinas Mecelis’s Covalis Capital sold off the biggest investment of all the hedgies watched by Insider Monkey, valued at an estimated $21.8 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund said goodbye to about $13.9 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 5 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Avangrid, Inc. (NYSE:AGR). We will take a look at Fifth Third Bancorp (NASDAQ:FITB), KeyCorp (NYSE:KEY), IAC/InterActiveCorp (NASDAQ:IAC), and CGI Inc. (NYSE:GIB). This group of stocks’ market valuations are closest to AGR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FITB | 31 | 775233 | 7 |

| KEY | 33 | 383374 | -8 |

| IAC | 50 | 1927773 | -1 |

| GIB | 17 | 362855 | 2 |

| Average | 32.75 | 862309 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $862 million. That figure was $348 million in AGR’s case. IAC/InterActiveCorp (NASDAQ:IAC) is the most popular stock in this table. On the other hand CGI Inc. (NYSE:GIB) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Avangrid, Inc. (NYSE:AGR) is even less popular than GIB. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately AGR wasn’t in this group. Hedge funds that bet on AGR were disappointed as the stock lost .2% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.