We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. That’s a big deal.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

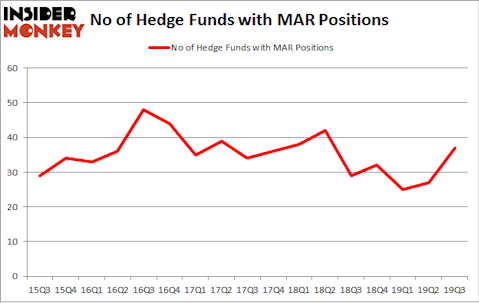

Marriott International Inc (NASDAQ:MAR) was in 37 hedge funds’ portfolios at the end of the third quarter of 2019. MAR investors should pay attention to an increase in enthusiasm from smart money of late. There were 27 hedge funds in our database with MAR positions at the end of the previous quarter. Our calculations also showed that MAR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are perceived as unimportant, old investment vehicles of yesteryear. While there are more than 8000 funds in operation at the moment, We hone in on the crème de la crème of this group, around 750 funds. These hedge fund managers manage most of the smart money’s total capital, and by following their matchless investments, Insider Monkey has found various investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Boykin Curry of Eagle Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the key hedge fund action encompassing Marriott International Inc (NASDAQ:MAR).

What does smart money think about Marriott International Inc (NASDAQ:MAR)?

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 37% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MAR over the last 17 quarters. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Eagle Capital Management, managed by Boykin Curry, holds the most valuable position in Marriott International Inc (NASDAQ:MAR). Eagle Capital Management has a $1.195 billion position in the stock, comprising 4.2% of its 13F portfolio. The second largest stake is held by Eric W. Mandelblatt and Gaurav Kapadia of Soroban Capital Partners, with a $602.7 million position; the fund has 8.5% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions comprise Tom Gayner’s Markel Gayner Asset Management, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Soroban Capital Partners allocated the biggest weight to Marriott International Inc (NASDAQ:MAR), around 8.48% of its portfolio. Steel Canyon Capital is also relatively very bullish on the stock, setting aside 5.42 percent of its 13F equity portfolio to MAR.

With a general bullishness amongst the heavyweights, some big names have jumped into Marriott International Inc (NASDAQ:MAR) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, established the largest position in Marriott International Inc (NASDAQ:MAR). Balyasny Asset Management had $51.4 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $12.5 million position during the quarter. The other funds with new positions in the stock are Donald Sussman’s Paloma Partners, Karim Abbadi and Edward McBride’s Centiva Capital, and Daniel Arbess’s Perella Weinberg Partners.

Let’s go over hedge fund activity in other stocks similar to Marriott International Inc (NASDAQ:MAR). These stocks are BB&T Corporation (NYSE:BBT), Dollar General Corporation (NYSE:DG), SYSCO Corporation (NYSE:SYY), and ING Groep N.V. (NYSE:ING). This group of stocks’ market valuations match MAR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBT | 26 | 370776 | 3 |

| DG | 45 | 2157250 | 8 |

| SYY | 22 | 3016032 | -9 |

| ING | 9 | 542281 | 1 |

| Average | 25.5 | 1521585 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $1522 million. That figure was $2446 million in MAR’s case. Dollar General Corporation (NYSE:DG) is the most popular stock in this table. On the other hand ING Groep N.V. (NYSE:ING) is the least popular one with only 9 bullish hedge fund positions. Marriott International Inc (NASDAQ:MAR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on MAR as the stock returned 13.3% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.