We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Melvin Capital’s recent GameStop losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Aon plc (NYSE:AON).

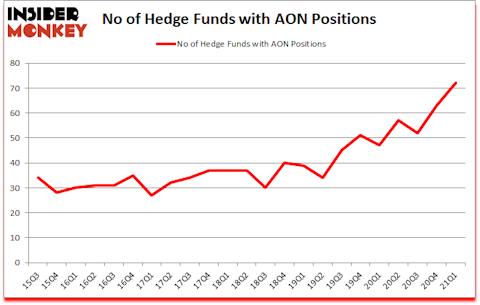

Aon plc (NYSE:AON) investors should be aware of an increase in hedge fund interest of late. Aon plc (NYSE:AON) was in 72 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic was previously 63. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that AON isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

To most traders, hedge funds are viewed as worthless, old financial vehicles of yesteryear. While there are over 8000 funds with their doors open at present, We look at the elite of this club, about 850 funds. It is estimated that this group of investors manage the majority of all hedge funds’ total capital, and by keeping track of their inimitable picks, Insider Monkey has spotted many investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website.

Paul Marshall of Marshall Wace

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s view the recent hedge fund action regarding Aon plc (NYSE:AON).

Do Hedge Funds Think AON Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 72 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AON over the last 23 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Aon plc (NYSE:AON) was held by Eagle Capital Management, which reported holding $1518.6 million worth of stock at the end of December. It was followed by Berkshire Hathaway with a $942.6 million position. Other investors bullish on the company included Farallon Capital, Viking Global, and BlueSpruce Investments. In terms of the portfolio weights assigned to each position Brave Warrior Capital allocated the biggest weight to Aon plc (NYSE:AON), around 11.49% of its 13F portfolio. LFL Advisers is also relatively very bullish on the stock, dishing out 8.84 percent of its 13F equity portfolio to AON.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Berkshire Hathaway, managed by Warren Buffett, initiated the largest position in Aon plc (NYSE:AON). Berkshire Hathaway had $942.6 million invested in the company at the end of the quarter. David Blood and Al Gore’s Generation Investment Management also made a $124 million investment in the stock during the quarter. The other funds with new positions in the stock are Barry Lebovits and Joshua Kuntz’s Rivulet Capital, Tom Purcell and Marco Tablada’s Alua Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s go over hedge fund activity in other stocks similar to Aon plc (NYSE:AON). These stocks are Koninklijke Philips NV (NYSE:PHG), General Dynamics Corporation (NYSE:GD), Spotify Technology S.A. (NYSE:SPOT), KLA Corporation (NASDAQ:KLAC), Twitter Inc (NYSE:TWTR), Regeneron Pharmaceuticals Inc (NASDAQ:REGN), and Canadian Pacific Railway Limited (NYSE:CP). This group of stocks’ market caps match AON’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHG | 11 | 104193 | 3 |

| GD | 31 | 5931757 | -9 |

| SPOT | 46 | 2991078 | -2 |

| KLAC | 40 | 1204040 | 4 |

| TWTR | 107 | 4534754 | 29 |

| REGN | 39 | 1308238 | -7 |

| CP | 33 | 5908185 | 9 |

| Average | 43.9 | 3140321 | 3.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43.9 hedge funds with bullish positions and the average amount invested in these stocks was $3140 million. That figure was $7768 million in AON’s case. Twitter Inc (NYSE:TWTR) is the most popular stock in this table. On the other hand Koninklijke Philips NV (NYSE:PHG) is the least popular one with only 11 bullish hedge fund positions. Aon plc (NYSE:AON) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AON is 71.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.8% in 2021 through August 6th and still beat the market by 6.7 percentage points. Hedge funds were also right about betting on AON, though not to the same extent, as the stock returned 14.1% since Q1 (through August 6th) and outperformed the market as well.

Follow Aon Plc (NYSE:AON)

Follow Aon Plc (NYSE:AON)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Fastest-Growing Fintech Companies

- 15 Most Popular Instand Messaging Apps

- 10 Best Dating Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.