“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Matson, Inc. (NYSE:MATX).

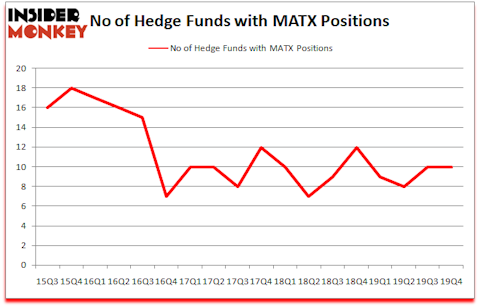

Matson, Inc. (NYSE:MATX) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the fourth quarter of 2019. At the end of this article we will also compare MATX to other stocks including IAMGOLD Corporation (NYSE:IAG), Fitbit Inc (NYSE:FIT), and Central Garden & Pet Co (NASDAQ:CENT) to get a better sense of its popularity.

To most shareholders, hedge funds are viewed as slow, old financial vehicles of years past. While there are more than 8000 funds trading today, We look at the aristocrats of this club, approximately 850 funds. These hedge fund managers shepherd the majority of the smart money’s total capital, and by monitoring their best picks, Insider Monkey has deciphered a number of investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

James Dondero of Highland Capital Management

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a look at the fresh hedge fund action regarding Matson, Inc. (NYSE:MATX).

Hedge fund activity in Matson, Inc. (NYSE:MATX)

At the end of the fourth quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in MATX a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Matson, Inc. (NYSE:MATX) was held by Renaissance Technologies, which reported holding $1.6 million worth of stock at the end of September. It was followed by Weld Capital Management with a $1.6 million position. Other investors bullish on the company included Citadel Investment Group, D E Shaw, and Balyasny Asset Management. In terms of the portfolio weights assigned to each position Weld Capital Management allocated the biggest weight to Matson, Inc. (NYSE:MATX), around 0.3% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, setting aside 0.21 percent of its 13F equity portfolio to MATX.

Seeing as Matson, Inc. (NYSE:MATX) has witnessed declining sentiment from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies who sold off their entire stakes heading into Q4. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP cut the biggest position of all the hedgies followed by Insider Monkey, valued at close to $1.3 million in stock. Israel Englander’s fund, Millennium Management, also cut its stock, about $0.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Matson, Inc. (NYSE:MATX) but similarly valued. These stocks are IAMGOLD Corporation (NYSE:IAG), Fitbit Inc (NYSE:FIT), Central Garden & Pet Co (NASDAQ:CENT), and Veoneer, Inc. (NYSE:VNE). All of these stocks’ market caps match MATX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IAG | 17 | 164270 | 3 |

| FIT | 24 | 208950 | 15 |

| CENT | 17 | 130671 | -8 |

| VNE | 11 | 150991 | 0 |

| Average | 17.25 | 163721 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $164 million. That figure was $6 million in MATX’s case. Fitbit Inc (NYSE:FIT) is the most popular stock in this table. On the other hand Veoneer, Inc. (NYSE:VNE) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Matson, Inc. (NYSE:MATX) is even less popular than VNE. Hedge funds dodged a bullet by taking a bearish stance towards MATX. Our calculations showed that the top 20 most popular hedge fund stocks returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but managed to beat the market by 4.2 percentage points. Unfortunately MATX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); MATX investors were disappointed as the stock returned -29.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.