It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Bank of Montreal (NYSE:BMO).

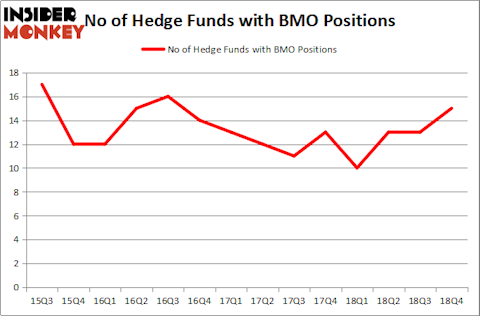

Is Bank of Montreal (NYSE:BMO) going to take off soon? The best stock pickers are in an optimistic mood. The number of long hedge fund bets advanced by 2 recently. Our calculations also showed that BMO isn’t among the 30 most popular stocks among hedge funds. BMO was in 15 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 13 hedge funds in our database with BMO holdings at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the recent hedge fund action regarding Bank of Montreal (NYSE:BMO).

What does the smart money think about Bank of Montreal (NYSE:BMO)?

Heading into the first quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from one quarter earlier. By comparison, 10 hedge funds held shares or bullish call options in BMO a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Arrowstreet Capital held the most valuable stake in Bank of Montreal (NYSE:BMO), which was worth $116.5 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $71.1 million worth of shares. Moreover, Two Sigma Advisors, AQR Capital Management, and Millennium Management were also bullish on Bank of Montreal (NYSE:BMO), allocating a large percentage of their portfolios to this stock.

Now, key money managers were leading the bulls’ herd. Stevens Capital Management, managed by Matthew Tewksbury, established the biggest position in Bank of Montreal (NYSE:BMO). Stevens Capital Management had $2.2 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $0.6 million position during the quarter. The following funds were also among the new BMO investors: Alec Litowitz and Ross Laser’s Magnetar Capital and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Bank of Montreal (NYSE:BMO). These stocks are ING Groep N.V. (NYSE:ING), Infosys Limited (NYSE:INFY), Zoetis Inc (NYSE:ZTS), and China Telecom Corporation Limited (NYSE:CHA). This group of stocks’ market valuations match BMO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ING | 7 | 507142 | -1 |

| INFY | 17 | 1043271 | -1 |

| ZTS | 45 | 1815851 | 4 |

| CHA | 8 | 25031 | 2 |

| Average | 19.25 | 847824 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $848 million. That figure was $392 million in BMO’s case. Zoetis Inc (NYSE:ZTS) is the most popular stock in this table. On the other hand ING Groep N.V. (NYSE:ING) is the least popular one with only 7 bullish hedge fund positions. Bank of Montreal (NYSE:BMO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on BMO as the stock returned 20.4% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.