Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

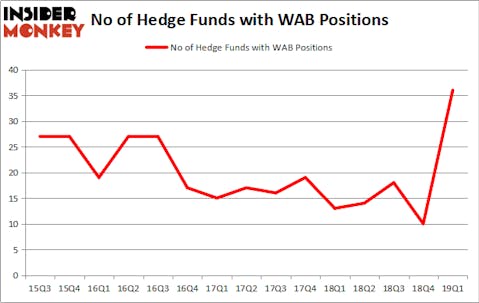

Westinghouse Air Brake Technologies Corp (NYSE:WAB) was in 36 hedge funds’ portfolios at the end of March. WAB investors should pay attention to an increase in hedge fund sentiment recently. There were 10 hedge funds in our database with WAB holdings at the end of the previous quarter. Our calculations also showed that WAB isn’t among the 30 most popular stocks among hedge funds.

Today there are a multitude of signals stock traders have at their disposal to evaluate publicly traded companies. A pair of the less known signals are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce the broader indices by a superb margin (see the details here).

We’re going to check out the new hedge fund action regarding Westinghouse Air Brake Technologies Corp (NYSE:WAB).

How have hedgies been trading Westinghouse Air Brake Technologies Corp (NYSE:WAB)?

At Q1’s end, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of 260% from the fourth quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in WAB a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Thomas Steyer’s Farallon Capital has the biggest position in Westinghouse Air Brake Technologies Corp (NYSE:WAB), worth close to $460.2 million, corresponding to 3.7% of its total 13F portfolio. The second largest stake is held by Gates Capital Management, led by Jeffrey Gates, holding a $74.4 million position; the fund has 3.3% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish contain Lee Hicks and Jan Koerner’s Park Presidio Capital, Richard S. Pzena’s Pzena Investment Management and Benjamin A. Smith’s Laurion Capital Management.

As industrywide interest jumped, key money managers were breaking ground themselves. Gates Capital Management, managed by Jeffrey Gates, established the biggest position in Westinghouse Air Brake Technologies Corp (NYSE:WAB). Gates Capital Management had $74.4 million invested in the company at the end of the quarter. Richard S. Pzena’s Pzena Investment Management also made a $67.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Benjamin A. Smith’s Laurion Capital Management, Boykin Curry’s Eagle Capital Management, and Javier Velazquez’s Albar Capital.

Let’s go over hedge fund activity in other stocks similar to Westinghouse Air Brake Technologies Corp (NYSE:WAB). These stocks are Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH), Noble Energy, Inc. (NYSE:NBL), C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), and Nomura Holdings, Inc. (NYSE:NMR). All of these stocks’ market caps are similar to WAB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NCLH | 35 | 1020481 | -5 |

| NBL | 24 | 615273 | -2 |

| CHRW | 30 | 407519 | 3 |

| NMR | 5 | 36674 | 0 |

| Average | 23.5 | 519987 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $520 million. That figure was $783 million in WAB’s case. Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Westinghouse Air Brake Technologies Corp (NYSE:WAB) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WAB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WAB were disappointed as the stock returned -13.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.