While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors kept their optimism regarding the current bull run in the fourth quarter, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Summit Materials Inc (NYSE:SUM).

Summit Materials Inc (NYSE:SUM) has seen a decrease in enthusiasm from smart money recently. Our calculations also showed that SUM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the fresh hedge fund action encompassing Summit Materials Inc (NYSE:SUM).

How have hedgies been trading Summit Materials Inc (NYSE:SUM)?

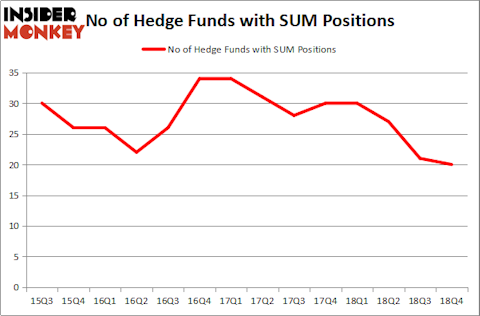

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the second quarter of 2018. By comparison, 30 hedge funds held shares or bullish call options in SUM a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Southeastern Asset Management was the largest shareholder of Summit Materials Inc (NYSE:SUM), with a stake worth $159 million reported as of the end of September. Trailing Southeastern Asset Management was Adage Capital Management, which amassed a stake valued at $94.6 million. Wallace R. Weitz & Co., Valueworks LLC, and Long Pond Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Since Summit Materials Inc (NYSE:SUM) has experienced declining sentiment from hedge fund managers, we can see that there was a specific group of hedgies that decided to sell off their positions entirely last quarter. At the top of the heap, Matthew Sidman’s Three Bays Capital cut the largest investment of the 700 funds monitored by Insider Monkey, valued at an estimated $83 million in stock. David Tepper’s fund, Appaloosa Management LP, also dropped its stock, about $54.2 million worth. These transactions are interesting, as total hedge fund interest dropped by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Summit Materials Inc (NYSE:SUM). These stocks are Seaspan Corporation (NYSE:SSW), Rush Enterprises, Inc. (NASDAQ:RUSHB), Magellan Health Inc (NASDAQ:MGLN), and SecureWorks Corp. (NASDAQ:SCWX). All of these stocks’ market caps resemble SUM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSW | 12 | 335655 | 4 |

| RUSHB | 3 | 31783 | -2 |

| MGLN | 15 | 299824 | -5 |

| SCWX | 9 | 35899 | 1 |

| Average | 9.75 | 175790 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $176 million. That figure was $408 million in SUM’s case. Magellan Health Inc (NASDAQ:MGLN) is the most popular stock in this table. On the other hand Rush Enterprises, Inc. (NASDAQ:RUSHB) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Summit Materials Inc (NYSE:SUM) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on SUM as the stock returned 28.5% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.