While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors kept their optimism regarding the current bull run in the fourth quarter, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Omega Flex, Inc. (NASDAQ:OFLX).

Is Omega Flex, Inc. (NASDAQ:OFLX) a buy right now? Investors who are in the know are becoming hopeful. The number of bullish hedge fund bets increased by 1 lately. Our calculations also showed that oflx isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the recent hedge fund action encompassing Omega Flex, Inc. (NASDAQ:OFLX).

What have hedge funds been doing with Omega Flex, Inc. (NASDAQ:OFLX)?

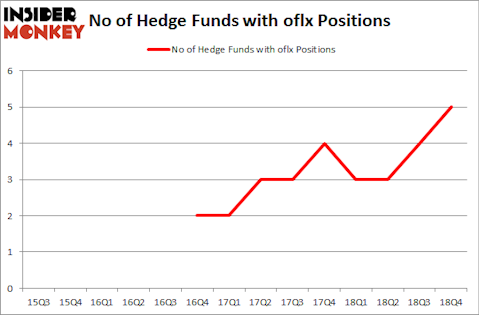

At the end of the fourth quarter, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OFLX over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Nine Ten Partners was the largest shareholder of Omega Flex, Inc. (NASDAQ:OFLX), with a stake worth $5.8 million reported as of the end of December. Trailing Nine Ten Partners was Renaissance Technologies, which amassed a stake valued at $2 million. Millennium Management, Citadel Investment Group, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Millennium Management, managed by Israel Englander, assembled the most outsized position in Omega Flex, Inc. (NASDAQ:OFLX). Millennium Management had $0.3 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.2 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Omega Flex, Inc. (NASDAQ:OFLX) but similarly valued. We will take a look at Synthorx, Inc. (NASDAQ:THOR), Rayonier Advanced Materials Inc (NYSE:RYAM), Sabine Royalty Trust (NYSE:SBR), and United Natural Foods, Inc. (NYSE:UNFI). This group of stocks’ market valuations are closest to OFLX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THOR | 5 | 300834 | 5 |

| RYAM | 19 | 102909 | -4 |

| SBR | 6 | 18768 | -1 |

| UNFI | 15 | 105716 | -6 |

| Average | 11.25 | 132057 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $132 million. That figure was $8 million in OFLX’s case. Rayonier Advanced Materials Inc (NYSE:RYAM) is the most popular stock in this table. On the other hand Synthorx, Inc. (NASDAQ:THOR) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Omega Flex, Inc. (NASDAQ:OFLX) is even less popular than THOR. Hedge funds clearly dropped the ball on OFLX as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on OFLX as the stock returned 67.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.