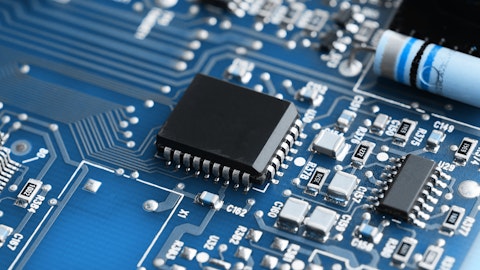

It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Microchip Technology Incorporated (NASDAQ:MCHP) during the quarter below.

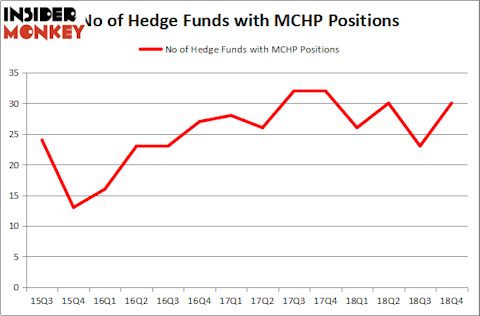

Microchip Technology Incorporated (NASDAQ:MCHP) was in 30 hedge funds’ portfolios at the end of December. MCHP has seen an increase in support from the world’s most elite money managers recently. There were 23 hedge funds in our database with MCHP positions at the end of the previous quarter. Our calculations also showed that MCHP isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the key hedge fund action encompassing Microchip Technology Incorporated (NASDAQ:MCHP).

Hedge fund activity in Microchip Technology Incorporated (NASDAQ:MCHP)

Heading into the first quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from the second quarter of 2018. By comparison, 26 hedge funds held shares or bullish call options in MCHP a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Platinum Asset Management was the largest shareholder of Microchip Technology Incorporated (NASDAQ:MCHP), with a stake worth $127.1 million reported as of the end of September. Trailing Platinum Asset Management was Alkeon Capital Management, which amassed a stake valued at $90.2 million. Partner Fund Management, Generation Investment Management, and Alyeska Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key hedge funds have been driving this bullishness. Partner Fund Management, managed by Christopher James, assembled the largest position in Microchip Technology Incorporated (NASDAQ:MCHP). Partner Fund Management had $74.3 million invested in the company at the end of the quarter. Andrew Weiss’s Weiss Asset Management also initiated a $36.8 million position during the quarter. The other funds with brand new MCHP positions are Bart Baum’s Ionic Capital Management, Howard Marks’s Oaktree Capital Management, and Noam Gottesman’s GLG Partners.

Let’s check out hedge fund activity in other stocks similar to Microchip Technology Incorporated (NASDAQ:MCHP). We will take a look at Synchrony Financial (NYSE:SYF), Deutsche Bank AG (NYSE:DB), Shinhan Financial Group Co., Ltd. (NYSE:SHG), and Teva Pharmaceutical Industries Limited (NYSE:TEVA). All of these stocks’ market caps resemble MCHP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYF | 40 | 2307219 | 5 |

| DB | 14 | 1068433 | 5 |

| SHG | 7 | 22057 | 5 |

| TEVA | 35 | 2006034 | -1 |

| Average | 24 | 1350936 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $1351 million. That figure was $426 million in MCHP’s case. Synchrony Financial (NYSE:SYF) is the most popular stock in this table. On the other hand Shinhan Financial Group Co., Ltd. (NYSE:SHG) is the least popular one with only 7 bullish hedge fund positions. Microchip Technology Incorporated (NASDAQ:MCHP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on MCHP as the stock returned 20.2% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.