Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

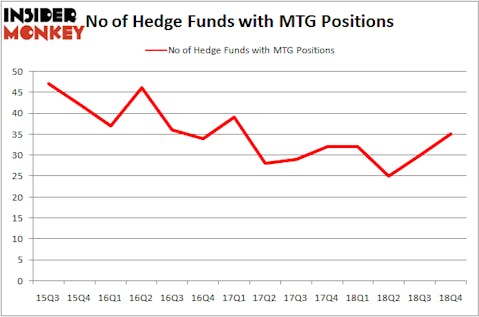

MGIC Investment Corporation (NYSE:MTG) shareholders have witnessed an increase in hedge fund sentiment recently. Our calculations also showed that MTG isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of tools investors have at their disposal to value publicly traded companies. Some of the most innovative tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outpace the broader indices by a healthy amount (see the details here).

We’re going to take a peek at the latest hedge fund action regarding MGIC Investment Corporation (NYSE:MTG).

How have hedgies been trading MGIC Investment Corporation (NYSE:MTG)?

Heading into the first quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from one quarter earlier. On the other hand, there were a total of 32 hedge funds with a bullish position in MTG a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the largest position in MGIC Investment Corporation (NYSE:MTG). Renaissance Technologies has a $59.1 million position in the stock, comprising 0.1% of its 13F portfolio. On Renaissance Technologies’s heels is GLG Partners, led by Noam Gottesman, holding a $43 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism contain Steve Cohen’s Point72 Asset Management, Ken Griffin’s Citadel Investment Group and Robert Joseph Caruso’s Select Equity Group.

As one would reasonably expect, specific money managers have been driving this bullishness. Shoals Capital Management, managed by Jeffrey Hinkle, assembled the most outsized position in MGIC Investment Corporation (NYSE:MTG). Shoals Capital Management had $12 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $9.6 million investment in the stock during the quarter. The other funds with brand new MTG positions are Vivian Lau’s One Tusk Investment Partners, Matthew Tewksbury’s Stevens Capital Management, and Ron Mass’s Almitas Capital.

Let’s now review hedge fund activity in other stocks similar to MGIC Investment Corporation (NYSE:MTG). We will take a look at Southwest Gas Holdings, Inc. (NYSE:SWX), Americold Realty Trust (NYSE:COLD), BWX Technologies Inc (NYSE:BWXT), and Black Hills Corporation (NYSE:BKH). This group of stocks’ market values are similar to MTG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWX | 17 | 225927 | 4 |

| COLD | 16 | 628764 | -5 |

| BWXT | 19 | 85950 | 2 |

| BKH | 17 | 114198 | -2 |

| Average | 17.25 | 263710 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $264 million. That figure was $358 million in MTG’s case. BWX Technologies Inc (NYSE:BWXT) is the most popular stock in this table. On the other hand Americold Realty Trust (NYSE:COLD) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks MGIC Investment Corporation (NYSE:MTG) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on MTG as the stock returned 31.5% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.