Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

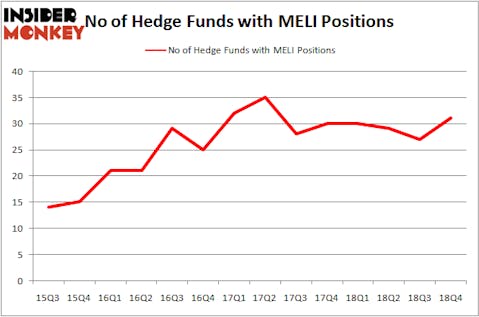

Is Mercadolibre Inc (NASDAQ:MELI) a healthy stock for your portfolio? The smart money is turning bullish. The number of long hedge fund bets advanced by 4 in recent months. Our calculations also showed that MELI isn’t among the 30 most popular stocks among hedge funds. MELI was in 31 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 27 hedge funds in our database with MELI positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action surrounding Mercadolibre Inc (NASDAQ:MELI).

Hedge fund activity in Mercadolibre Inc (NASDAQ:MELI)

Heading into the first quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from one quarter earlier. On the other hand, there were a total of 30 hedge funds with a bullish position in MELI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Alkeon Capital Management held the most valuable stake in Mercadolibre Inc (NASDAQ:MELI), which was worth $365 million at the end of the third quarter. On the second spot was Generation Investment Management which amassed $321 million worth of shares. Moreover, D1 Capital Partners, Lone Pine Capital, and Tiger Global Management LLC were also bullish on Mercadolibre Inc (NASDAQ:MELI), allocating a large percentage of their portfolios to this stock.

Now, key money managers have been driving this bullishness. D1 Capital Partners, managed by Daniel Sundheim, initiated the largest position in Mercadolibre Inc (NASDAQ:MELI). D1 Capital Partners had $207.9 million invested in the company at the end of the quarter. Edmond M. Safra’s EMS Capital also initiated a $25.2 million position during the quarter. The other funds with brand new MELI positions are Stanley Druckenmiller’s Duquesne Capital, Israel Englander’s Millennium Management, and Bijan Modanlou, Joseph Bou-Saba, and Jayaveera Kodali’s Alta Park Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Mercadolibre Inc (NASDAQ:MELI). We will take a look at Restaurant Brands International Inc (NYSE:QSR), Franco-Nevada Corporation (NYSE:FNV), Liberty Broadband Corp (NASDAQ:LBRDK), and Vulcan Materials Company (NYSE:VMC). All of these stocks’ market caps match MELI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QSR | 37 | 3179351 | -3 |

| FNV | 23 | 425505 | 7 |

| LBRDK | 35 | 2832635 | -2 |

| VMC | 41 | 1535477 | 6 |

| Average | 34 | 1993242 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1993 million. That figure was $1208 million in MELI’s case. Vulcan Materials Company (NYSE:VMC) is the most popular stock in this table. On the other hand Franco-Nevada Corporation (NYSE:FNV) is the least popular one with only 23 bullish hedge fund positions. Mercadolibre Inc (NASDAQ:MELI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on MELI as the stock returned 66.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.