Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost more than 25%. Facebook, which was the second most popular stock, lost 20% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the first 2.5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

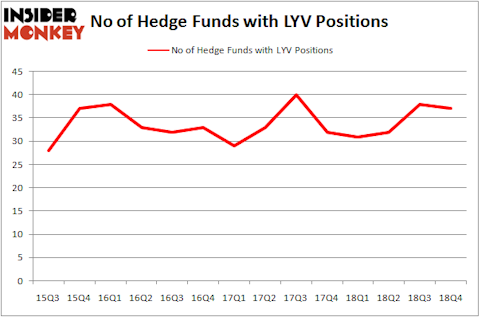

Is Live Nation Entertainment, Inc. (NYSE:LYV) a bargain? Hedge funds are reducing their bets on the stock. The number of bullish hedge fund positions shrunk by 1 recently. Nevertheless, overall hedge fund sentiment towards the stock is still near its all time high.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action regarding Live Nation Entertainment, Inc. (NYSE:LYV).

How are hedge funds trading Live Nation Entertainment, Inc. (NYSE:LYV)?

At Q4’s end, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from one quarter earlier. On the other hand, there were a total of 31 hedge funds with a bullish position in LYV a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Select Equity Group, managed by Robert Joseph Caruso, holds the biggest position in Live Nation Entertainment, Inc. (NYSE:LYV). Select Equity Group has a $339.5 million position in the stock, comprising 2.6% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, managed by Jim Simons, which holds a $110 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions include Murray Stahl’s Horizon Asset Management, Ric Dillon’s Diamond Hill Capital and Mario Gabelli’s GAMCO Investors.

Due to the fact that Live Nation Entertainment, Inc. (NYSE:LYV) has witnessed declining sentiment from the smart money, logic holds that there is a sect of fund managers that decided to sell off their entire stakes by the end of the third quarter. It’s worth mentioning that David Fiszel’s Honeycomb Asset Management said goodbye to the largest stake of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $40.9 million in stock. Amit Nitin Doshi’s fund, Harbor Spring Capital, also dropped its stock, about $26.3 million worth. These moves are interesting, as total hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Live Nation Entertainment, Inc. (NYSE:LYV) but similarly valued. We will take a look at Domino’s Pizza, Inc. (NYSE:DPZ), HEICO Corporation (NYSE:HEI), Hasbro, Inc. (NASDAQ:HAS), and Eastman Chemical Company (NYSE:EMN). This group of stocks’ market valuations are closest to LYV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DPZ | 32 | 1859638 | 4 |

| HEI | 31 | 731968 | 1 |

| HAS | 19 | 254690 | -1 |

| EMN | 33 | 437187 | 8 |

| Average | 28.75 | 820871 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $821 million. That figure was $862 million in LYV’s case. Eastman Chemical Company (NYSE:EMN) is the most popular stock in this table. On the other hand Hasbro, Inc. (NASDAQ:HAS) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Live Nation Entertainment, Inc. (NYSE:LYV) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on LYV as the stock returned 28.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.