Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 13.5% in the fourth quarter. Seven out of 11 industry groups in the S&P 500 Index were down more than 20% from their 52-week highs at the trough of the stock market crash. The average return of a randomly picked stock in the index was even worse. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 15 most popular S&P 500 stocks among hedge funds not only recouped their Q4 losses but also outperformed the index by more than 3 percentage points. In this article, we will take a look at what hedge funds think about iQIYI, Inc. (NASDAQ:IQ).

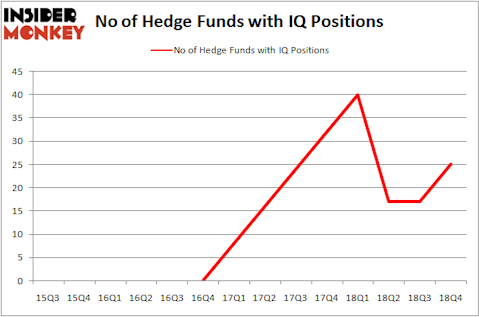

Is iQIYI, Inc. (NASDAQ:IQ) the right pick for your portfolio? Hedge funds are in an optimistic mood. The number of bullish hedge fund positions rose by 8 in recent months. Our calculations also showed that IQ isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are perceived as unimportant, outdated investment vehicles of years past. While there are greater than 8000 funds trading today, Our researchers hone in on the aristocrats of this group, around 750 funds. These money managers shepherd the majority of the smart money’s total capital, and by observing their finest investments, Insider Monkey has brought to light many investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a look at the key hedge fund action surrounding iQIYI, Inc. (NASDAQ:IQ).

What does the smart money think about iQIYI, Inc. (NASDAQ:IQ)?

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 47% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards IQ over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Hillhouse Capital Management held the most valuable stake in iQIYI, Inc. (NASDAQ:IQ), which was worth $510.2 million at the end of the third quarter. On the second spot was Viking Global which amassed $65.8 million worth of shares. Moreover, ExodusPoint Capital, Citadel Investment Group, and Renaissance Technologies were also bullish on iQIYI, Inc. (NASDAQ:IQ), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were breaking ground themselves. ExodusPoint Capital, managed by Michael Gelband, established the most outsized position in iQIYI, Inc. (NASDAQ:IQ). ExodusPoint Capital had $25.4 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $16.1 million position during the quarter. The other funds with brand new IQ positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Josh Donfeld and David Rogers’s Castle Hook Partners, and Brandon Haley’s Holocene Advisors.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as iQIYI, Inc. (NASDAQ:IQ) but similarly valued. These stocks are Wynn Resorts, Limited (NASDAQ:WYNN), Vedanta Ltd (NYSE:VEDL), Western Digital Corporation (NASDAQ:WDC), and Icahn Enterprises LP (NASDAQ:IEP). All of these stocks’ market caps match IQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WYNN | 46 | 1928962 | 3 |

| VEDL | 7 | 55731 | 2 |

| WDC | 25 | 566493 | -8 |

| IEP | 6 | 10137794 | 2 |

| Average | 21 | 3172245 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $3172 million. That figure was $718 million in IQ’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Icahn Enterprises LP (NASDAQ:IEP) is the least popular one with only 6 bullish hedge fund positions. iQIYI, Inc. (NASDAQ:IQ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on IQ as the stock returned 81.7% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.