During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Gardner Denver Holdings, Inc. (NYSE:GDI) and see how the stock is affected by the recent hedge fund activity.

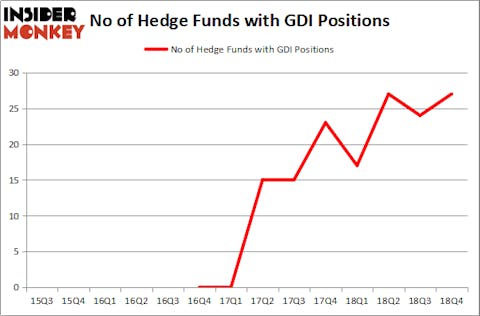

Is Gardner Denver Holdings, Inc. (NYSE:GDI) undervalued? The best stock pickers are getting more optimistic. The number of long hedge fund positions advanced by 3 in recent months. Our calculations also showed that GDI isn’t among the 30 most popular stocks among hedge funds. GDI was in 27 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 24 hedge funds in our database with GDI positions at the end of the previous quarter.

Today there are many methods investors employ to evaluate publicly traded companies. Two of the most underrated methods are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outpace the market by a solid amount (see the details here).

We’re going to take a glance at the recent hedge fund action regarding Gardner Denver Holdings, Inc. (NYSE:GDI).

What does the smart money think about Gardner Denver Holdings, Inc. (NYSE:GDI)?

At Q4’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the second quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in GDI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Adage Capital Management held the most valuable stake in Gardner Denver Holdings, Inc. (NYSE:GDI), which was worth $71 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $63.1 million worth of shares. Moreover, Alyeska Investment Group, Goodnow Investment Group, and Millennium Management were also bullish on Gardner Denver Holdings, Inc. (NYSE:GDI), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds have jumped into Gardner Denver Holdings, Inc. (NYSE:GDI) headfirst. Holocene Advisors, managed by Brandon Haley, initiated the largest position in Gardner Denver Holdings, Inc. (NYSE:GDI). Holocene Advisors had $17.1 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $16.3 million position during the quarter. The other funds with brand new GDI positions are Benjamin A. Smith’s Laurion Capital Management, Wallace Weitz’s Wallace R. Weitz & Co., and Alexander Roepers’s Atlantic Investment Management.

Let’s go over hedge fund activity in other stocks similar to Gardner Denver Holdings, Inc. (NYSE:GDI). We will take a look at Bilibili Inc. (NASDAQ:BILI), Syneos Health, Inc. (NASDAQ:SYNH), Embraer SA (NYSE:ERJ), and PacWest Bancorp (NASDAQ:PACW). This group of stocks’ market caps match GDI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BILI | 20 | 320474 | 4 |

| SYNH | 24 | 213141 | -3 |

| ERJ | 10 | 74442 | -1 |

| PACW | 21 | 209624 | -5 |

| Average | 18.75 | 204420 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $204 million. That figure was $362 million in GDI’s case. Syneos Health, Inc. (NASDAQ:SYNH) is the most popular stock in this table. On the other hand Embraer SA (NYSE:ERJ) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Gardner Denver Holdings, Inc. (NYSE:GDI) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on GDI as the stock returned 33.6% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.