Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Costamare Inc (NYSE:CMRE).

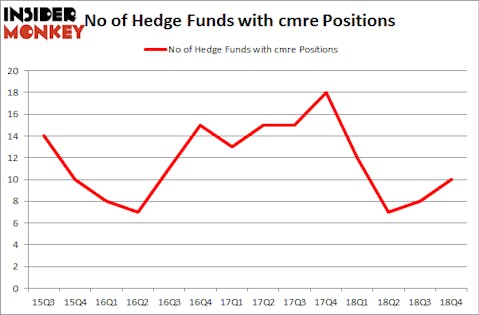

Is Costamare Inc (NYSE:CMRE) undervalued? The smart money is getting more optimistic. The number of bullish hedge fund bets advanced by 2 in recent months. Our calculations also showed that cmre isn’t among the 30 most popular stocks among hedge funds. CMRE was in 10 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 8 hedge funds in our database with CMRE holdings at the end of the previous quarter.

According to most traders, hedge funds are assumed to be underperforming, outdated investment vehicles of the past. While there are greater than 8000 funds in operation today, We hone in on the masters of this group, around 750 funds. Most estimates calculate that this group of people shepherd bulk of the smart money’s total asset base, and by monitoring their matchless equity investments, Insider Monkey has unearthed many investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s review the latest hedge fund action encompassing Costamare Inc (NYSE:CMRE).

What does the smart money think about Costamare Inc (NYSE:CMRE)?

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CMRE over the last 14 quarters. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in Costamare Inc (NYSE:CMRE) was held by Renaissance Technologies, which reported holding $7.5 million worth of stock at the end of December. It was followed by Horizon Asset Management with a $1.1 million position. Other investors bullish on the company included Two Sigma Advisors, Arrowstreet Capital, and D E Shaw.

As aggregate interest increased, key hedge funds have jumped into Costamare Inc (NYSE:CMRE) headfirst. D E Shaw, managed by D. E. Shaw, initiated the largest position in Costamare Inc (NYSE:CMRE). D E Shaw had $0.4 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $0.1 million position during the quarter. The only other fund with a brand new CMRE position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks similar to Costamare Inc (NYSE:CMRE). These stocks are Epizyme Inc (NASDAQ:EPZM), Hometrust Bancshares Inc (NASDAQ:HTBI), Transenterix Inc (NYSE:TRXC), and Forty Seven, Inc. (NASDAQ:FTSV). This group of stocks’ market values match CMRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPZM | 18 | 120880 | 3 |

| HTBI | 9 | 65265 | 0 |

| TRXC | 8 | 11314 | -6 |

| FTSV | 6 | 23618 | -1 |

| Average | 10.25 | 55269 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $55 million. That figure was $11 million in CMRE’s case. Epizyme Inc (NASDAQ:EPZM) is the most popular stock in this table. On the other hand Forty Seven, Inc. (NASDAQ:FTSV) is the least popular one with only 6 bullish hedge fund positions. Costamare Inc (NYSE:CMRE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CMRE as the stock returned 33.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.