Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

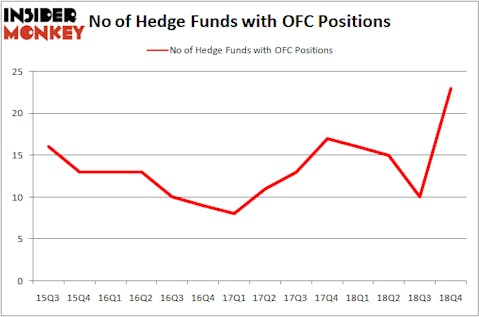

Is Corporate Office Properties Trust (NYSE:OFC) the right investment to pursue these days? Hedge funds are taking a bullish view. The number of long hedge fund bets advanced by 13 in recent months. Our calculations also showed that OFC isn’t among the 30 most popular stocks among hedge funds. OFC was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 10 hedge funds in our database with OFC positions at the end of the previous quarter.

To the average investor there are tons of tools shareholders put to use to grade their stock investments. A duo of the most useful tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top investment managers can beat their index-focused peers by a solid amount (see the details here).

We’re going to take a glance at the key hedge fund action surrounding Corporate Office Properties Trust (NYSE:OFC).

Hedge fund activity in Corporate Office Properties Trust (NYSE:OFC)

At the end of the fourth quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 130% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in OFC a year ago. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the largest position in Corporate Office Properties Trust (NYSE:OFC). Renaissance Technologies has a $25.5 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Renaissance Technologies’s heels is Balyasny Asset Management, managed by Dmitry Balyasny, which holds a $20.6 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism contain D. E. Shaw’s D E Shaw, David Harding’s Winton Capital Management and Israel Englander’s Millennium Management.

As industrywide interest jumped, specific money managers have been driving this bullishness. D E Shaw, managed by D. E. Shaw, created the biggest position in Corporate Office Properties Trust (NYSE:OFC). D E Shaw had $20.5 million invested in the company at the end of the quarter. Eduardo Abush’s Waterfront Capital Partners also initiated a $6 million position during the quarter. The other funds with brand new OFC positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, Paul Tudor Jones’s Tudor Investment Corp, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Corporate Office Properties Trust (NYSE:OFC). These stocks are Mercury Systems Inc (NASDAQ:MRCY), The Dolan Company (NYSE:DM), Domtar Corporation (NYSE:UFS), and PolyOne Corporation (NYSE:POL). All of these stocks’ market caps resemble OFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRCY | 6 | 19557 | -5 |

| DM | 5 | 13327 | 1 |

| UFS | 25 | 102549 | 3 |

| POL | 19 | 87717 | 4 |

| Average | 13.75 | 55788 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $56 million. That figure was $137 million in OFC’s case. Domtar Corporation (NYSE:UFS) is the most popular stock in this table. On the other hand The Dolan Company (NYSE:DM) is the least popular one with only 5 bullish hedge fund positions. Corporate Office Properties Trust (NYSE:OFC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on OFC as the stock returned 30.3% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.