Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the fourth quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to AGCO Corporation (NYSE:AGCO) changed recently.

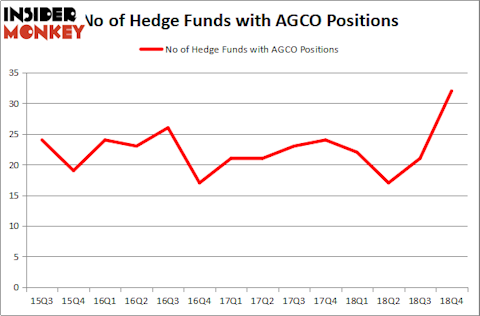

Is AGCO Corporation (NYSE:AGCO) the right investment to pursue these days? Hedge funds are getting more bullish. The number of long hedge fund positions rose by 11 in recent months. Our calculations also showed that AGCO isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the recent hedge fund action surrounding AGCO Corporation (NYSE:AGCO).

How are hedge funds trading AGCO Corporation (NYSE:AGCO)?

At the end of the fourth quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 52% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AGCO over the last 14 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Millennium Management held the most valuable stake in AGCO Corporation (NYSE:AGCO), which was worth $67 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $24.9 million worth of shares. Moreover, Carlson Capital, Impax Asset Management, and Winton Capital Management were also bullish on AGCO Corporation (NYSE:AGCO), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds were breaking ground themselves. Two Sigma Advisors, managed by John Overdeck and David Siegel, assembled the largest position in AGCO Corporation (NYSE:AGCO). Two Sigma Advisors had $9.3 million invested in the company at the end of the quarter. Nick Niell’s Arrowgrass Capital Partners also made a $8.9 million investment in the stock during the quarter. The other funds with brand new AGCO positions are Steve Cohen’s Point72 Asset Management, Joel Greenblatt’s Gotham Asset Management, and Jonathan Barrett and Paul Segal’s Luminus Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as AGCO Corporation (NYSE:AGCO) but similarly valued. These stocks are Lazard Ltd (NYSE:LAZ), Prosperity Bancshares, Inc. (NYSE:PB), W.R. Grace & Co. (NYSE:GRA), and Life Storage, Inc. (NYSE:LSI). This group of stocks’ market caps match AGCO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LAZ | 16 | 481052 | -1 |

| PB | 9 | 53292 | 3 |

| GRA | 37 | 1688168 | 0 |

| LSI | 13 | 159045 | 1 |

| Average | 18.75 | 595389 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $595 million. That figure was $239 million in AGCO’s case. W.R. Grace & Co. (NYSE:GRA) is the most popular stock in this table. On the other hand Prosperity Bancshares, Inc. (NYSE:PB) is the least popular one with only 9 bullish hedge fund positions. AGCO Corporation (NYSE:AGCO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on AGCO as the stock returned 30.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.