How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding The AES Corporation (NYSE:AES).

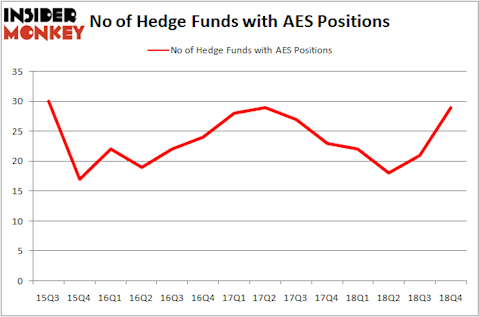

Is The AES Corporation (NYSE:AES) going to take off soon? Investors who are in the know are turning bullish. The number of bullish hedge fund bets advanced by 8 lately. Our calculations also showed that AES isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the recent hedge fund action regarding The AES Corporation (NYSE:AES).

What does the smart money think about The AES Corporation (NYSE:AES)?

At the end of the fourth quarter, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in AES a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The AES Corporation (NYSE:AES) was held by AQR Capital Management, which reported holding $87.5 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $49.3 million position. Other investors bullish on the company included Two Sigma Advisors, ValueAct Capital, and Winton Capital Management.

Consequently, specific money managers were breaking ground themselves. Stevens Capital Management, managed by Matthew Tewksbury, created the most valuable position in The AES Corporation (NYSE:AES). Stevens Capital Management had $7.9 million invested in the company at the end of the quarter. Anna Nikolayevsky’s Axel Capital Management also initiated a $7.2 million position during the quarter. The other funds with brand new AES positions are Peter J. Hark’s Shelter Harbor Advisors, Ray Dalio’s Bridgewater Associates, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The AES Corporation (NYSE:AES) but similarly valued. We will take a look at Brookfield Infrastructure Partners L.P. (NYSE:BIP), Pinnacle West Capital Corporation (NYSE:PNW), Fibria Celulose SA (NYSE:FBR), and Agnico Eagle Mines Limited (NYSE:AEM). This group of stocks’ market valuations are closest to AES’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIP | 8 | 25087 | 2 |

| PNW | 26 | 701194 | 6 |

| FBR | 3 | 177216 | -3 |

| AEM | 25 | 271170 | 10 |

| Average | 15.5 | 293667 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $294 million. That figure was $289 million in AES’s case. Pinnacle West Capital Corporation (NYSE:PNW) is the most popular stock in this table. On the other hand Fibria Celulose SA (NYSE:FBR) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks The AES Corporation (NYSE:AES) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on AES as the stock returned 27.6% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.