We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the fourth quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of Fair Isaac Corporation (NYSE:FICO) based on that data.

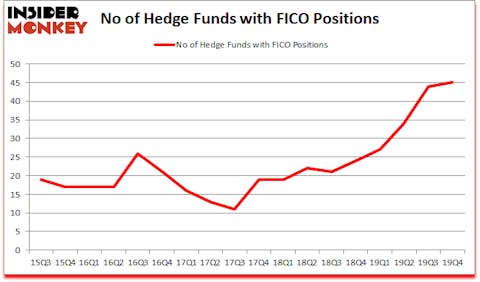

Fair Isaac Corporation (NYSE:FICO) investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. FICO was in 45 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 44 hedge funds in our database with FICO positions at the end of the previous quarter. Our calculations also showed that FICO isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the eyes of most market participants, hedge funds are viewed as unimportant, outdated investment tools of yesteryear. While there are over 8000 funds trading at present, We choose to focus on the crème de la crème of this club, approximately 850 funds. These money managers command the lion’s share of the hedge fund industry’s total asset base, and by observing their unrivaled picks, Insider Monkey has determined a number of investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Gabriel Plotkin of Melvin Capital Management

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to check out the latest hedge fund action encompassing Fair Isaac Corporation (NYSE:FICO).

How are hedge funds trading Fair Isaac Corporation (NYSE:FICO)?

Heading into the first quarter of 2020, a total of 45 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 2% from the previous quarter. The graph below displays the number of hedge funds with bullish position in FICO over the last 18 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Melvin Capital Management held the most valuable stake in Fair Isaac Corporation (NYSE:FICO), which was worth $215.4 million at the end of the third quarter. On the second spot was Ako Capital which amassed $153.4 million worth of shares. Newbrook Capital Advisors, Valley Forge Capital, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Valley Forge Capital allocated the biggest weight to Fair Isaac Corporation (NYSE:FICO), around 24.26% of its 13F portfolio. Broad Bay Capital is also relatively very bullish on the stock, designating 12.22 percent of its 13F equity portfolio to FICO.

Consequently, specific money managers have been driving this bullishness. Melvin Capital Management, managed by Gabriel Plotkin, established the biggest position in Fair Isaac Corporation (NYSE:FICO). Melvin Capital Management had $215.4 million invested in the company at the end of the quarter. Nicolai Tangen’s Ako Capital also made a $153.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Gregg Moskowitz’s Interval Partners, Philip Hilal’s Clearfield Capital, and William Heard’s Heard Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Fair Isaac Corporation (NYSE:FICO) but similarly valued. We will take a look at Aramark (NYSE:ARMK), PerkinElmer, Inc. (NYSE:PKI), Eastman Chemical Company (NYSE:EMN), and Teva Pharmaceutical Industries Limited (NYSE:TEVA). This group of stocks’ market values resemble FICO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARMK | 36 | 2127604 | 1 |

| PKI | 20 | 841222 | -5 |

| EMN | 32 | 493987 | 2 |

| TEVA | 23 | 943507 | -1 |

| Average | 27.75 | 1101580 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $1102 million. That figure was $1457 million in FICO’s case. Aramark (NYSE:ARMK) is the most popular stock in this table. On the other hand PerkinElmer, Inc. (NYSE:PKI) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Fair Isaac Corporation (NYSE:FICO) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.3% in 2020 through May 1st but still managed to beat the market by 12.9 percentage points. Hedge funds were also right about betting on FICO, though not to the same extent, as the stock returned -10.2% in 2020 (through May 1st) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.