You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

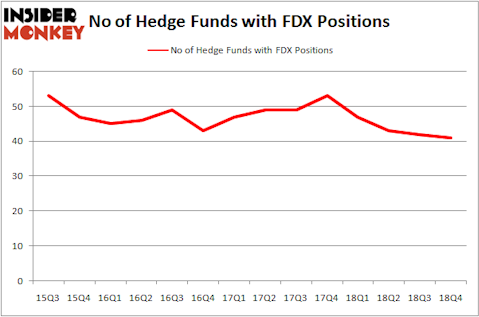

FedEx Corporation (NYSE:FDX) was in 41 hedge funds’ portfolios at the end of the fourth quarter of 2018. FDX has seen a decrease in enthusiasm from smart money lately. There were 42 hedge funds in our database with FDX holdings at the end of the previous quarter. Our calculations also showed that FDX isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the fresh hedge fund action regarding FedEx Corporation (NYSE:FDX).

How are hedge funds trading FedEx Corporation (NYSE:FDX)?

At Q4’s end, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from the previous quarter. On the other hand, there were a total of 47 hedge funds with a bullish position in FDX a year ago. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Michael Larson’s Bill & Melinda Gates Foundation Trust has the biggest position in FedEx Corporation (NYSE:FDX), worth close to $488 million, comprising 2.2% of its total 13F portfolio. Coming in second is Greenhaven Associates, led by Edgar Wachenheim, holding a $440.4 million position; 8.5% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish contain Mason Hawkins’s Southeastern Asset Management, Cliff Asness’s AQR Capital Management and Anthony Bozza’s Lakewood Capital Management.

Seeing as FedEx Corporation (NYSE:FDX) has faced declining sentiment from the smart money, it’s easy to see that there lies a certain “tier” of hedge funds that decided to sell off their full holdings last quarter. At the top of the heap, Alexander Mitchell’s Scopus Asset Management dropped the largest stake of all the hedgies tracked by Insider Monkey, totaling close to $120.4 million in stock. John Brennan’s fund, Sirios Capital Management, also dropped its stock, about $40.6 million worth. These moves are interesting, as total hedge fund interest fell by 1 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to FedEx Corporation (NYSE:FDX). We will take a look at Illinois Tool Works Inc. (NYSE:ITW), Bank of Montreal (NYSE:BMO), ING Groep N.V. (NYSE:ING), and Infosys Limited (NYSE:INFY). All of these stocks’ market caps resemble FDX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ITW | 28 | 293072 | 2 |

| BMO | 15 | 392379 | 2 |

| ING | 7 | 507142 | -1 |

| INFY | 17 | 1043271 | -1 |

| Average | 16.75 | 558966 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $559 million. That figure was $2196 million in FDX’s case. Illinois Tool Works Inc. (NYSE:ITW) is the most popular stock in this table. On the other hand ING Groep N.V. (NYSE:ING) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks FedEx Corporation (NYSE:FDX) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately FDX wasn’t in this group. Hedge funds that bet on FDX were disappointed as the stock returned 10.7% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.