“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Ascena Retail Group Inc (NASDAQ:ASNA) and see how it was affected.

Is Ascena Retail Group Inc (NASDAQ:ASNA) a sound investment right now? The smart money is in a pessimistic mood. The number of bullish hedge fund positions shrunk by 5 in recent months. Our calculations also showed that asna isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several formulas market participants use to analyze publicly traded companies. Two of the less utilized formulas are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite money managers can outclass the broader indices by a healthy amount (see the details here).

We’re going to view the recent hedge fund action regarding Ascena Retail Group Inc (NASDAQ:ASNA).

How are hedge funds trading Ascena Retail Group Inc (NASDAQ:ASNA)?

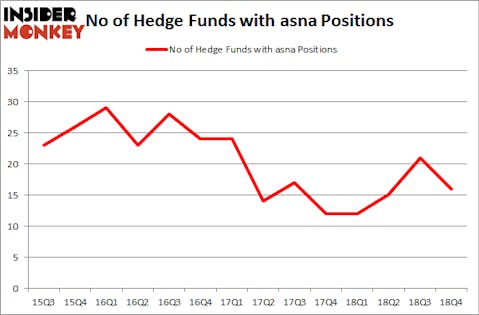

At the end of the fourth quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ASNA over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Stadium Capital Management held the most valuable stake in Ascena Retail Group Inc (NASDAQ:ASNA), which was worth $48.3 million at the end of the fourth quarter. On the second spot was Renaissance Technologies which amassed $17.9 million worth of shares. Moreover, Arrowstreet Capital, Royce & Associates, and AQR Capital Management were also bullish on Ascena Retail Group Inc (NASDAQ:ASNA), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Ascena Retail Group Inc (NASDAQ:ASNA) has experienced falling interest from the smart money, logic holds that there was a specific group of hedgies that slashed their entire stakes in the third quarter. It’s worth mentioning that Israel Englander’s Millennium Management sold off the biggest position of the 700 funds watched by Insider Monkey, worth an estimated $3.9 million in stock. Jeffrey Talpins’s fund, Element Capital Management, also dumped its stock, about $0.4 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 5 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ascena Retail Group Inc (NASDAQ:ASNA) but similarly valued. These stocks are Teekay Offshore Partners L.P. (NYSE:TOO), Mechel PAO (NYSE:MTL), Sinovac Biotech Ltd. (NASDAQ:SVA), and Just Energy Group, Inc. (NYSE:JE). All of these stocks’ market caps resemble ASNA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TOO | 8 | 13953 | 1 |

| MTL | 4 | 697 | 1 |

| SVA | 4 | 77430 | 1 |

| JE | 9 | 21413 | -3 |

| Average | 6.25 | 28373 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $78 million in ASNA’s case. Just Energy Group, Inc. (NYSE:JE) is the most popular stock in this table. On the other hand Mechel PAO (NYSE:MTL) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Ascena Retail Group Inc (NASDAQ:ASNA) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ASNA wasn’t nearly as popular as these 15 stock and hedge funds that were betting on ASNA were disappointed as the stock returned -58.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.