The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Antero Midstream Corp (NYSE:AM).

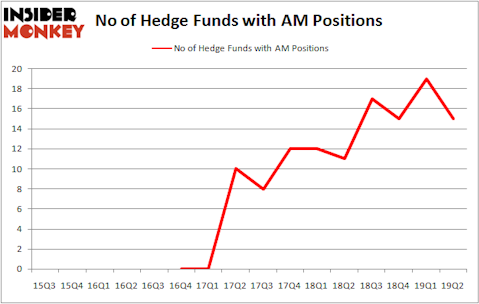

Antero Midstream Corp (NYSE:AM) has experienced a decrease in enthusiasm from smart money in recent months. Our calculations also showed that AM isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the latest hedge fund action surrounding Antero Midstream Corp (NYSE:AM).

How have hedgies been trading Antero Midstream Corp (NYSE:AM)?

Heading into the third quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from one quarter earlier. By comparison, 11 hedge funds held shares or bullish call options in AM a year ago. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, FPR Partners, managed by Bob Peck and Andy Raab, holds the most valuable position in Antero Midstream Corp (NYSE:AM). FPR Partners has a $110.3 million position in the stock, comprising 2.6% of its 13F portfolio. On FPR Partners’s heels is Zimmer Partners, managed by Stuart J. Zimmer, which holds a $74.5 million position; 0.8% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism comprise Alan Fournier’s Pennant Capital Management, Mitch Cantor’s Mountain Lake Investment Management and Glenn Greenberg’s Brave Warrior Capital.

Seeing as Antero Midstream Corp (NYSE:AM) has experienced bearish sentiment from the smart money, we can see that there lies a certain “tier” of funds who were dropping their full holdings last quarter. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the biggest investment of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $26.5 million in stock. Guy Shahar’s fund, DSAM Partners, also cut its stock, about $5.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Antero Midstream Corp (NYSE:AM) but similarly valued. We will take a look at Vipshop Holdings Limited (NYSE:VIPS), Cullen/Frost Bankers, Inc. (NYSE:CFR), InterXion Holding NV (NYSE:INXN), and World Wrestling Entertainment, Inc. (NYSE:WWE). This group of stocks’ market valuations are similar to AM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VIPS | 17 | 153693 | 0 |

| CFR | 18 | 63124 | 0 |

| INXN | 34 | 754902 | 9 |

| WWE | 39 | 978036 | -8 |

| Average | 27 | 487439 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $487 million. That figure was $234 million in AM’s case. World Wrestling Entertainment, Inc. (NYSE:WWE) is the most popular stock in this table. On the other hand Vipshop Holdings Limited (NYSE:VIPS) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Antero Midstream Corp (NYSE:AM) is even less popular than VIPS. Hedge funds dodged a bullet by taking a bearish stance towards AM. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately AM wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); AM investors were disappointed as the stock returned -33.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.